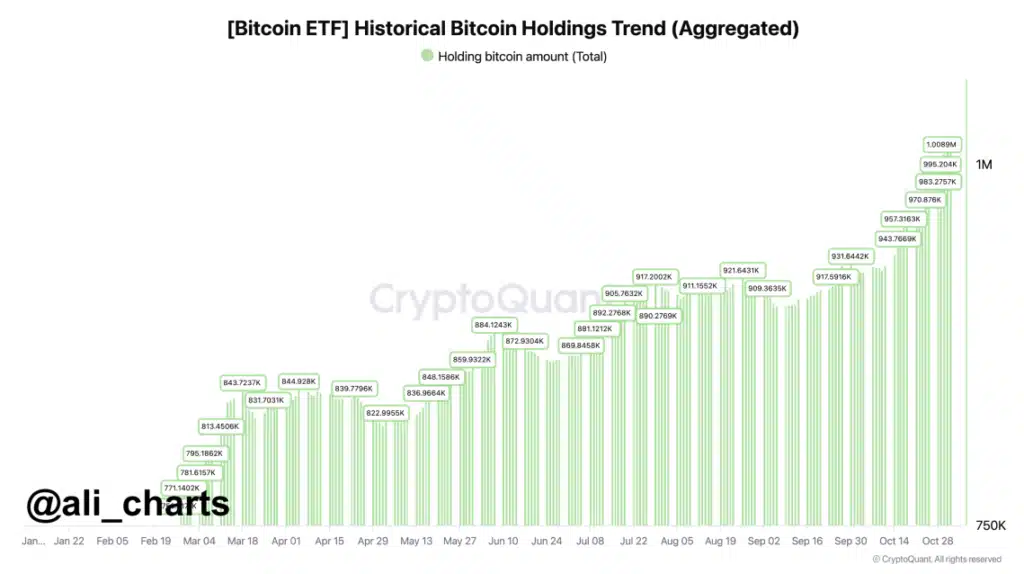

Bitcoin exchange-traded funds (ETFs) have collectively amassed over one million BTC in less than a year since their launch, highlighting substantial investor demand for direct exposure to the digital asset.

Bitcoin ETFs Reach 1 Million BTC Milestone

As noted in a recent chart by crypto analyst Ali Martinez, Bitcoin ETFs have now surpassed one million BTC holdings—a significant milestone that underscores the rapid institutional adoption of Bitcoin.

This development follows the U.S. Securities and Exchange Commission’s (SEC) approval of spot Bitcoin ETFs in January. Since then, these ETFs have brought in over $24.15 billion in net inflows, with the total value of BTC held in ETFs now estimated at approximately $70 billion. Over this period, Bitcoin’s price has risen from around $41,900 in early January to $68,941, representing an impressive 65% increase. In March, BTC also hit a record high of $73,737, further boosting investor interest.

With over one million BTC now allocated to ETFs, these funds control roughly 5% of Bitcoin’s capped 21 million supply—a factor that reinforces the asset’s scarcity appeal.

Leading Bitcoin ETFs and Market Trends

Among the leading ETFs, BlackRock’s IBIT spot BTC ETF tops the market, holding approximately $30 billion in net assets. Grayscale’s GBTC follows with $15.22 billion, while Fidelity’s FBTC ranks third with $10.47 billion.

Growing interest in Bitcoin ETFs aligns with a broader trend in digital asset investment. According to a CoinShares report, digital asset products recorded inflows of over $2.2 billion last week, driven partly by increased political speculation in the lead-up to the 2024 U.S. presidential election. Higher inflows were recorded earlier in the week, tapering toward the end as Democratic candidate Kamala Harris’s odds of winning improved, influencing investor sentiment.

At present, prediction markets show Harris at a 41.6% likelihood of winning, while Republican candidate Donald Trump holds a lead with a 58.5% probability, adding another dimension of political uncertainty to the financial markets.

Outlook

As Bitcoin ETFs continue to grow their holdings, the products’ influence on Bitcoin’s market dynamics will likely expand, reinforcing the asset’s scarcity and further driving institutional interest in cryptocurrency investment.

Read us in Google News

Read us in Google News