Adjusting the cryptocurrency investment portfolio

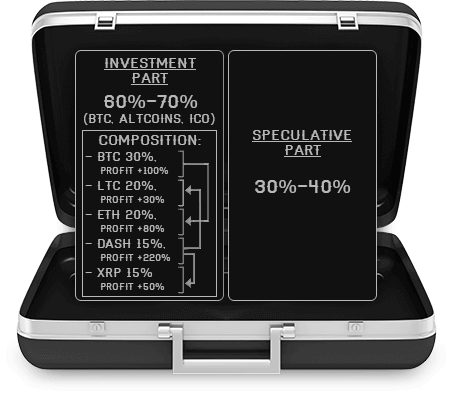

So, earlier we have formed the investment part of the portfolio by: BTC 30%, LTC 20%, ETH 20%, DASH 15%, XRP 15%. After three weeks, for example, we have the following total profitability: BTC + 100%, LTC + 30%, ETH + 80%, DASH + 220%, XRP + 50%. The first idea, usually for beginners, is the following: “According to DASH, the profitability amounted to as much as 220%, and I have only 15% of the total investment portfolio calculated for it. You need to get rid of LTC, ETH, XRP assets faster and invest all these funds in DASH, Well, BTC can be left, 100% is certainly not 220%, but not bad as well.”

If you have a similar situation and thoughts, in the process of your investment activity, throw it away as far as possible. Such actions are fundamentally false. It is necessary to redistribute funds in such a way as to return to the initial state of the portfolio: BTC 30%, LTC 20%, ETH 20%, DASH 15%, XRP 15%. Thus, we must distribute the maximum possible profit of DASH, in our case, to the most unprofitable or marginal assets of LTC and XRP. The profit from BTC is distributed towards ETH. You should be aware of the fact that the same DASH and BTC, in our case, will not always show such a profitability and, probably, there were reasons for such growth. And where the growth is, there is a correction. Corrections in the market can be very deep, up to 65% -70% of growth.

Adjusting the cryptocurrency investment portfolio

Remember the specifics of the cryptocurrency market, rapid ups (for example Ripple growth) and the rapid falls at the same time. Acting in this way and balancing your investments, you minimize the impact of subsequent corrections and the fall of the price of your profitable assets on your portfolio. Rollbacks in price, correction, unjustified market expectations, negative news background, etc. (and sooner or later it will necessarily happen, do not even doubt it), for assets that showed you a good profit, will not affect your investment portfolio so much. And at the same time, assets that showed the least profitability, due to any negative circumstances, in the future, their growth will offset losses on instruments that are growing now. Rises and falls are natural and happen on any instruments. Your task is to select assets for the portfolio in such a way that they grow and fall at different times, i.e. had not a direct correlation, but a reverse one.

You may get the false impression that the investment portfolio will not bring you enough profit, especially if you had the experience of trading on Forex before that, where investment portfolios justify themselves to a lesser extent. This impression is deceptive. The market of cryptocurrency is less similar to Forex and to a greater extent behaves like stock exchanges. Therefore, the strategies that work here are justified by those who work on the fund. Of course, investing and speculative trading have similar features somewhere, and many do not understand the differences between them and are persistently trying to promote their forex vision to the crypto market. But we can assure you that the investment portfolios of cryptocurrencies bring much more profit than the usual speculative accounts. The main task here is to form a portfolio competently and to balance it with proper timing. If you learn to do it correctly, you will not fail.

The speculative part of the portfolio will be discussed in detail in the next part of the article. Subscribe to our news not to miss the publication.

We also recommend to read another article of the author “How to trade cryptocurrency“.