Composition and management of the portfolio’s investment part

To start with, you can include the following instruments in the portfolio’s investment part:

– BTC, as the main instrument of the crypto market;

– Altcoins, you can take one of two of the largest by capitalization after bitcoin or any of the other “alive” coins if you have special preferences;

– ICO, this is a very controversial and questionable point because any ICO, without exception, is a long-term and very high-risk investment.

With the ICO, you need to be very careful, especially in light of the proliferating scam projects. It is better to choose a replacement with additional ALT from among the top, then the risk will be significantly lower. But if you are sure that any of the ICO you know at the moment is worthy to invest your money in it, and you have the resources for it and the possibility of the investment is available – you can safely include it in your “cold” wallet.

Composition and management of the portfolio’s investment part

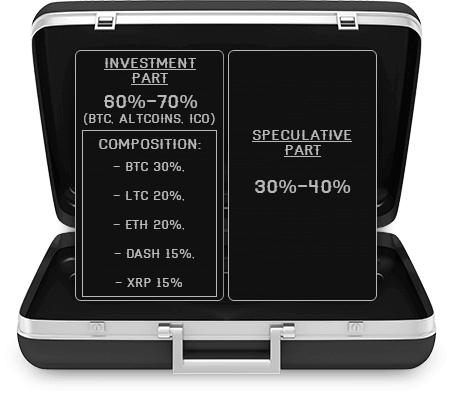

As an example, we will form the initial investment part of our portfolio consisting of: BTC 30%, LTC 20%, ETH 20%, DASH 15%, XRP 15%. The change in composition and the percentage of assets acquired will be adjusted over time, and then you will periodically re-adjust the investment components of your portfolio. The frequency of such re-adjustments can vary depending on the events in the market of cryptocurrencies, informational background, your personal preferences and free time. The essence of this process is reduced to the constant monitoring of cryptocurrency news and all sorts of events for each instrument in which you invested, as well as to promptly change the filling of the portfolio, before the market reacts to the news or the upcoming event. To successfully manage your investment portfolio, you should strive to receive the latest information first, to seek reliable insider information and respond to it as quickly as possible, re-adjusting your portfolio, thereby preparing to get the maximum benefit from the inevitable reaction of the market and the crowd. Remember – who owns the information, owns the world.

After you have adjusted your portfolio, you leave it for some time in peace so that it will work. To be engaged in optimization and balancing of your “cold” wallet, as well as analyzing charts, planning and analyzing your further actions, either on the investment portfolio, and on your speculative transactions, should be done at the moment of a calm market, i.e. before the news, before starting futures, etc., it is recommended to be done once a week or two. On weekends, for example, it would be good to re-adjust the portfolio and determine its tactics of behavior for the next week. During the same trading week, you can only adjust your plans or give up some of their parts at all. But cardinally change something on the move, right at the moment, some kind of market momentum or sudden shock news – never worth it, and especially in terms of your investment portfolio – strongly discouraged.

Continue reading on the next page