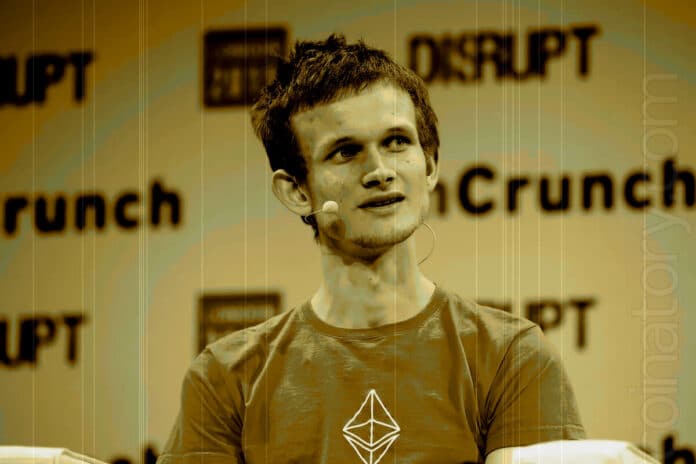

Vitalik Buterin, co-founder of Ethereum (ETH), recently shared his disappointment about the direction central bank digital currencies (CBDCs) have taken in a conversation with CNBC. He once had higher hopes for CBDCs, envisioning them to be more innovative and transformative. However, he feels that they’ve essentially become mere extensions of the conventional banking system.

Buterin mentioned, “I was hopeful about CBDCs about five years ago. Many aimed to integrate blockchain’s transparency, verifiability, and some level of privacy. But as these projects evolved, they seemed to shift from their initial vision. What we now see are systems that aren’t much of an improvement over our current payment methods, acting merely as a new interface for the same old banking processes.”

Buterin expressed concerns over privacy, believing CBDCs won’t offer the kind of discretion one might expect from digital currencies. He emphasized that these digital currencies might grant governments and businesses increased surveillance over financial transactions. He stated, “CBDCs could erode privacy even further, weakening protections against both corporate and governmental scrutiny.”

Highlighting Ethereum’s resilience, Buterin noted that it might be less susceptible to governmental intervention. He credited this to Ethereum’s transition to a proof-of-stake consensus method, explaining, “Proof-of-stake is more anonymous and difficult to disrupt than proof-of-work. The latter demands significant physical resources and power consumption, making it an easier target for authorities with experience in tracking such operations.”

Read us in Google News

Read us in Google News