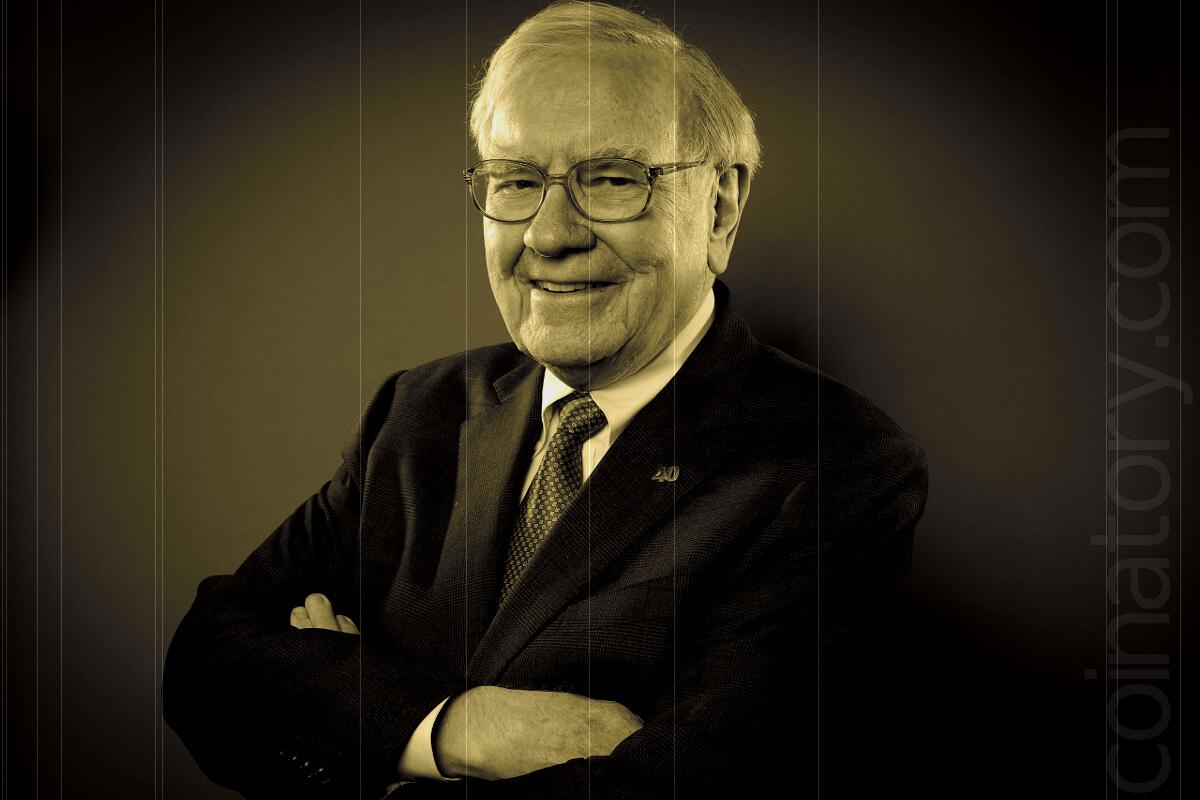

Warren Buffett, the legendary investor known as the “Oracle of Omaha,” confirmed during Berkshire Hathaway’s 2025 annual shareholder meeting that he will step down as Chief Executive Officer by the end of the year. Greg Abel, Vice Chairman in charge of non-insurance operations, is expected to assume the role, pending unanimous approval from the board of directors.

Buffett, who transformed Berkshire Hathaway over six decades from a struggling textile manufacturer into a $1.16 trillion conglomerate, will remain with the firm in an advisory capacity. He clarified that while he will provide counsel, ultimate decision-making authority will transfer to Abel.

Abel, a 62-year-old Canadian executive, joined Berkshire in 1992 and currently oversees several of its major subsidiaries, including Berkshire Hathaway Energy, BNSF Railway, and Dairy Queen. He was formally named Buffett’s successor in 2021 and is widely regarded as a steady hand committed to preserving the company’s decentralized operating structure.

During the meeting, Buffett emphasized the timeliness of the transition. “The time has arrived when Greg should become the Chief Executive Officer of the company at year-end,” he stated, underscoring his confidence in Abel’s leadership.

Berkshire Hathaway continues to hold significant market clout, with its Class A shares valued at over $809,000 and its portfolio including stakes in blue-chip firms such as Apple and Coca-Cola. As of March 31, 2025, the conglomerate reported record cash reserves totaling $348 billion, highlighting Buffett’s traditionally conservative stance amid frothy equity valuations.

Despite this, Berkshire’s investment performance has recently come under scrutiny. Since 2020, Bitcoin has surged more than 780%, far outpacing Berkshire’s 150% gain over the same period. Buffett, a long-standing skeptic of cryptocurrencies, has repeatedly dismissed Bitcoin’s legitimacy, arguing that the digital asset lacks intrinsic value and does not qualify as a credible investment.

Buffett’s retirement marks the end of an era for one of the most influential figures in global finance. As the firm turns to Abel to lead its next chapter, investors and analysts will closely watch how Berkshire adapts to a rapidly evolving investment landscape.