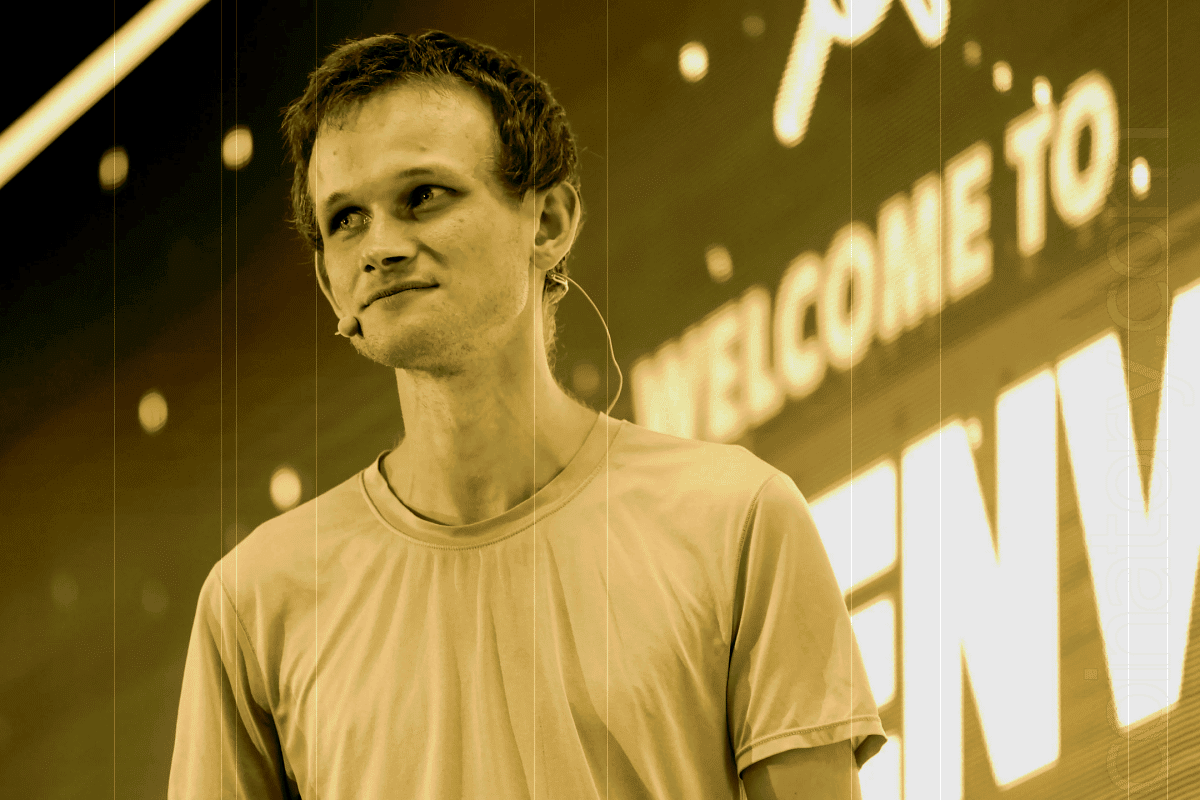

Ethereum co-founder Vitalik Buterin has sharply criticized MicroStrategy chairman Michael Saylor over recent comments suggesting that crypto users should rely on large financial institutions to hold custody of Bitcoin. Buterin took to X (formerly Twitter), calling Saylor “batshit insane” after Saylor’s interview with financial markets reporter Madison Reidy on October 21, 2024.

In the interview, Saylor advocated for regulatory capture, implying that Bitcoin custody should be managed by regulated entities such as major banks. He argued that such institutions are better equipped to protect digital assets and could attract more regulatory support, positioning them as the optimal custodians in a world increasingly concerned with security and compliance. Buterin and other figures in the crypto community, including Casa’s chief security officer Jameson Lopp and ShapeShift founder Erik Voorhees, disagreed, pointing out that relying on third-party custodians undermines the decentralized ethos of cryptocurrencies like Bitcoin.

Buterin, a vocal proponent of self-custody, emphasized the risks associated with concentrating crypto assets in the hands of large institutions. “There’s plenty of precedent for how this strategy can fail, and for me, it’s not what crypto is about,” he said in his post.

Saylor, however, remains concerned about non-regulated entities, or what he terms “crypto-anarchists,” who avoid governmental oversight. He believes that the lack of regulation in these entities increases the risk of digital assets being seized. This latest position stands in contrast to his previous advocacy for self-custody, where he encouraged individuals to hold their own private keys rather than entrusting assets to banks or exchanges.

Saylor’s shift comes despite his 2022 comments, made shortly after the FTX collapse, when he suggested that individuals, families, and businesses should have the ability to manage their own Bitcoin holdings. His company, MicroStrategy, holds 252,220 BTC, the largest corporate Bitcoin reserve, with Saylor himself owning over $1 billion in Bitcoin as of August 2024.