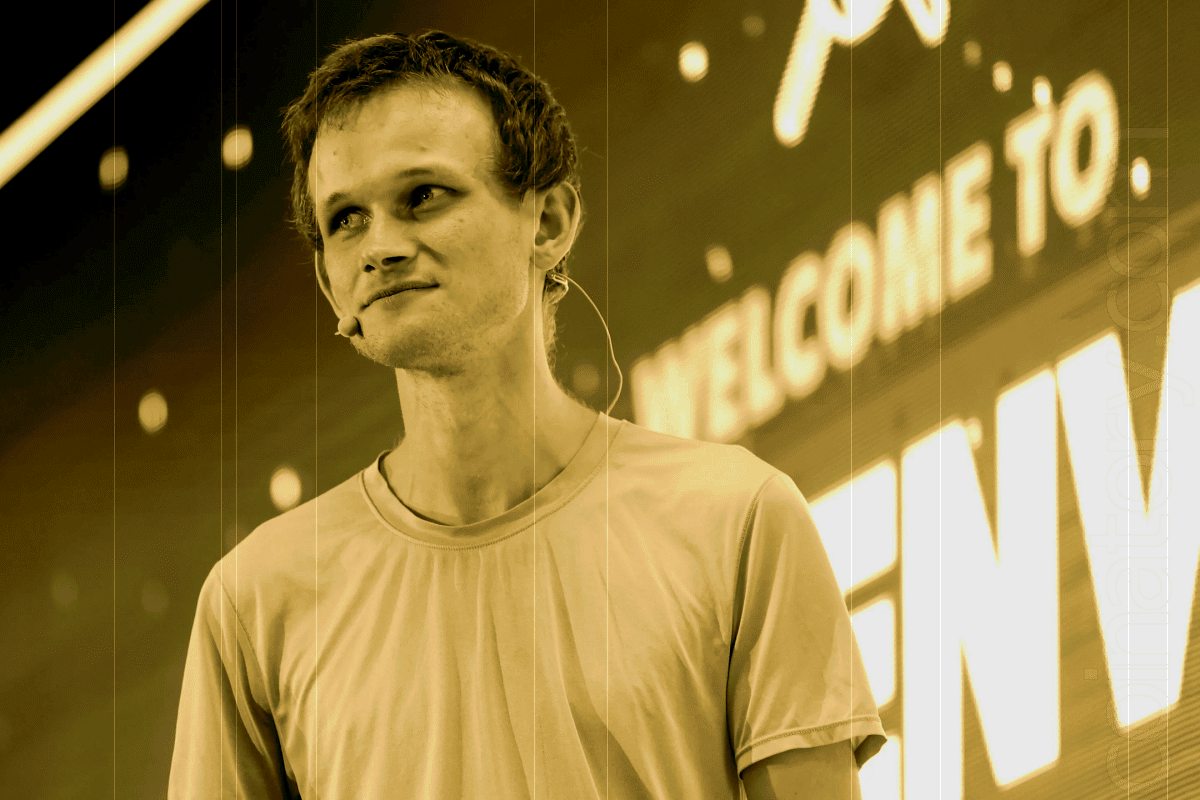

Ethereum co-founder Vitalik Buterin has recently offloaded a variety of meme coins he received for free, netting him approximately $2.24 million. On-chain analysis by Lookonchain reveals that Buterin sold 908.77 ETH, converting tokens from several joke-based projects into funds.

The largest sale involved 10 billion MOODENG tokens, earning him 395.96 ETH, valued at $976,000. Additional transactions included 200,000 MSTR for 93.23 ETH ($231,000), 500 million EBULL for 73.79 ETH ($182,000), and 15 million Popcat, which generated 27.11 ETH ($67,000).

Other notable sales featured 20 billion MILO for 20.75 ETH ($51,000), 11.06 trillion FWOG for 14 ETH ($35,000), and 50.53 billion SATO tokens, securing 11.34 ETH ($28,000).

Buterin’s Support for Meme Coins

While liquidating his meme coin holdings, Buterin reaffirmed his appreciation for projects that allocate portions of their supply to charitable causes. In a recent tweet, he stated, “I appreciate all the meme coins that donate portions of their supply directly to charity. Anything that gets sent to me gets donated to charity too.”

Buterin highlighted that a donation of 10 billion MOODENG tokens would go toward anti-airborne disease technology. He emphasized, however, that it’s preferable for projects to donate directly to charities or create decentralized autonomous organizations (DAOs) to manage charitable contributions.

Market Surge and Volatility

Buterin’s meme coin sell-off coincides with a notable uptick in the meme coin market, driven largely by renewed retail investor interest. Meme coins, including Dogecoin (DOGE) and Shiba Inu (SHIB), are benefiting from broader crypto market optimism, often referred to as “Uptober.”

However, meme coins linked to political movements or prominent figures, such as MAGA (TRUMP), remain highly volatile. The price of TRUMP, for example, surged dramatically following public events but dropped by 13.18% in the last 24 hours, reflecting the inherent risk associated with these assets.