Calls to Free Crypto Advocate Roger Ver Are Joined by Vitalik Buterin

Leading figures in the bitcoin industry are supporting Roger Ver, an early Bitcoin investor and advocate who is being sued by the U.S. Department of Justice (DOJ), after the successful effort to liberate Silk Road founder Ross Ulbricht.

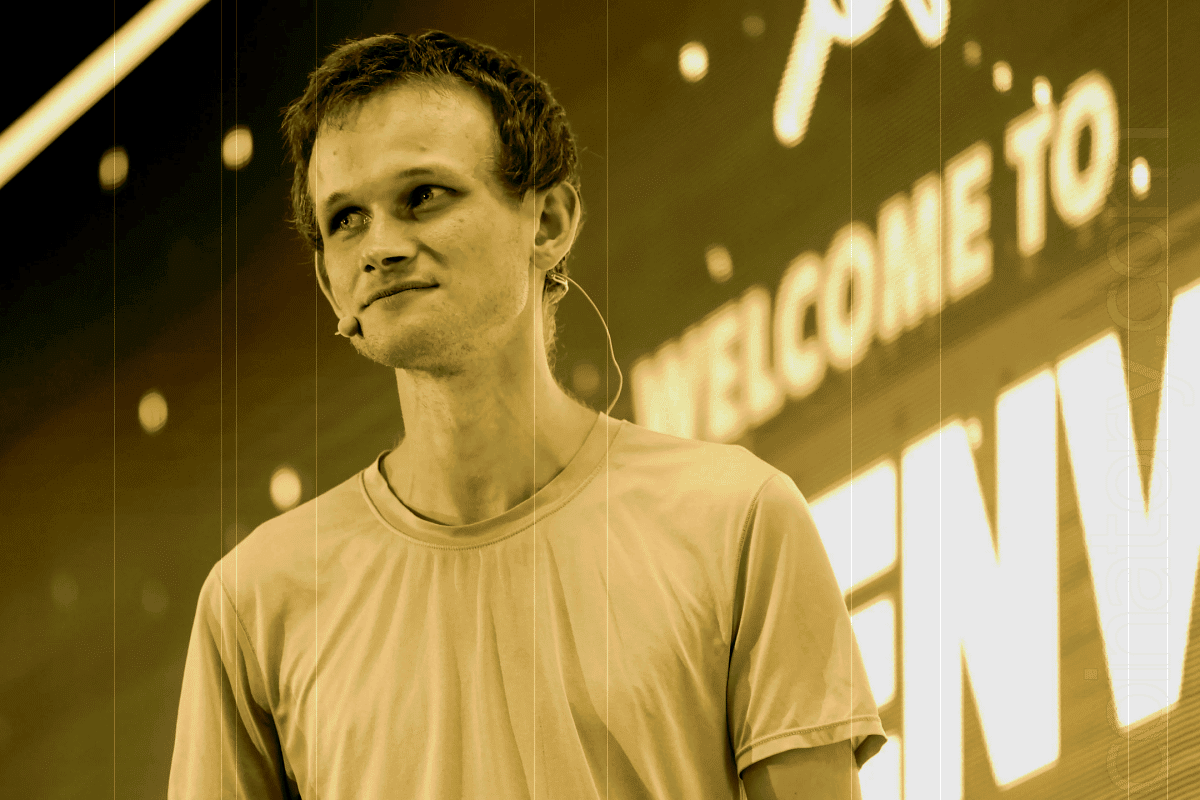

Proclamations for Ver’s release have been publicly endorsed by Ethereum co-founder Vitalik Buterin, who has called the prosecution “absurd” and “politically motivated.” Buterin slammed the U.S. citizenship-based taxation system, calling it “extreme” in comparison to other countries, and shared Ulbricht’s post supporting Ver.

“The departure tax regime and tax-by-citizenship system in the United States are harsh. Nearly no other nations in the world share the former, and the latter is at the top end of the range of what other nations do; for example, the UK only levies capital gains taxes if you return within five years,” Buterin said.

Concerning the IRS’s actions in Ver’s case, he also said that the organization “intimidated Roger’s lawyers to obtain privileged information.”

Roger Ver’s Court Case Against the DOJ

On April 30, 2024, Roger Ver was charged by the DOJ with tax evasion. After then, the businessman was taken into custody in Spain, where he was held for a few weeks. Ver secured his release on May 17, 2024, after posting $163,000 in bail, with the stipulations that he must stay in Spain, turn in his passport, and appear in court every two days.

Ver’s lawyers filed a motion to have the charges dropped on December 3, 2024, claiming that the U.S. departure tax, which is imposed on Americans who have more than $2 million in investable assets, violates the Due Process and Apportionment Clauses of the U.S. Constitution.

The DOJ’s activities have drawn criticism from cryptocurrency investors and industry advocates who claim that the lawsuit against Ver is a part of a larger anti-crypto strategy under the Biden administration. Ver insists that his indictment stems from his outspoken support of cryptocurrencies rather than taxes.

Increasing Demands for Tax Reform in the US

Ver’s legal issues coincide with growing calls for substantial tax reform from American people and policymakers. A lot of people are demanding that the Internal Revenue Service (IRS) be abolished and that the current tax structure be changed, especially with regard to the departure taxes that are levied on US residents who renounce their citizenship.

As the case develops, it keeps igniting discussion about how taxation, political reasons, and cryptocurrency legislation intertwine.