New guidelines for the application of Value Added Tax (VAT) to cryptocurrency mining operations have been released by the Federal Tax Authority (FTA) of the United Arab Emirates (UAE). Although mining cryptocurrencies for personal use is still VAT-free, services rendered to third parties will be liable to the usual 5% VAT rate.

Explanations of Taxable Mining Operations

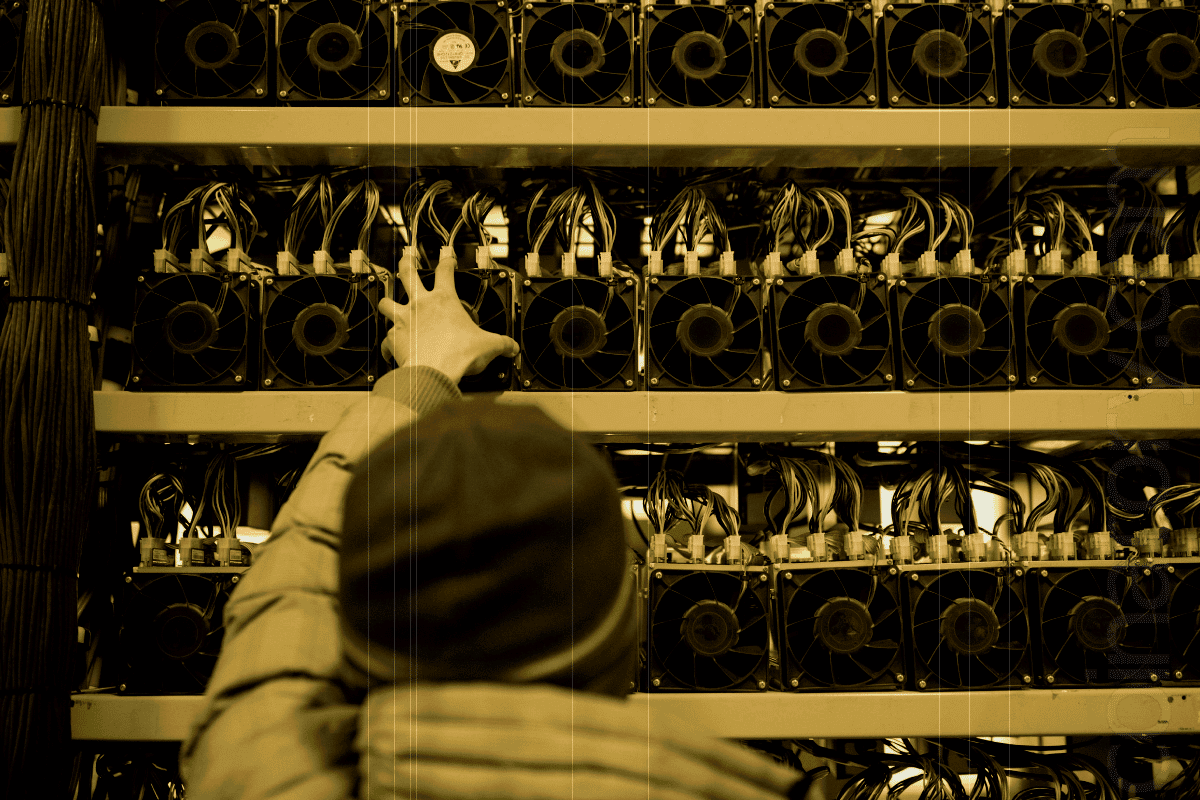

The method of employing specialized computers, or “mining rigs,” to verify blockchain transactions in return for incentives is known as cryptocurrency mining, according to the FTA. The FTA states that mining for personal use is not a taxable supply and is therefore exempt from the VAT.

On the other hand, miners who charge others for processing power or transaction validation are considered to be rendering taxable services. Since there is an identifiable recipient and payment for the action, these services are liable to VAT.

Tips for Miners on Input Tax Recovery

Input tax recovery provisions were also made clearer by the FTA:

Personal Mining: Since personal mining expenses are not linked to taxable supplies, they are not eligible for input tax collection. Examples of these expenses include hardware, utilities, and real estate.

Third-Party Mining: As long as they keep accurate records, including tax invoices, registered miners who work for third parties are eligible to get input tax reimbursement for costs incurred for taxable activities.

Tax Repercussions and Exemptions for Non-Residents

The FTA underlined that, if all conditions are satisfied, services rendered to non-resident firms may be eligible for zero-rating under Article 31 of Cabinet Decision No. 52 of 2017. On the other hand, companies in the UAE that buy mining services from non-residents are required to record the VAT associated with those transactions.

- Important Lessons for Crypto Miners

- VAT does not apply to personal bitcoin mining activity.

- Taxes apply to services that are provided to third parties, such as blockchain validation or processing power.

- Only registered miners who are engaged in taxable operations are eligible for input tax recovery.

- Depending on regulatory requirements, transactions involving non-residents may be zero-rated.

- This action demonstrates the UAE’s attempts to improve bitcoin tax laws while encouraging participants’ clarity and compliance.