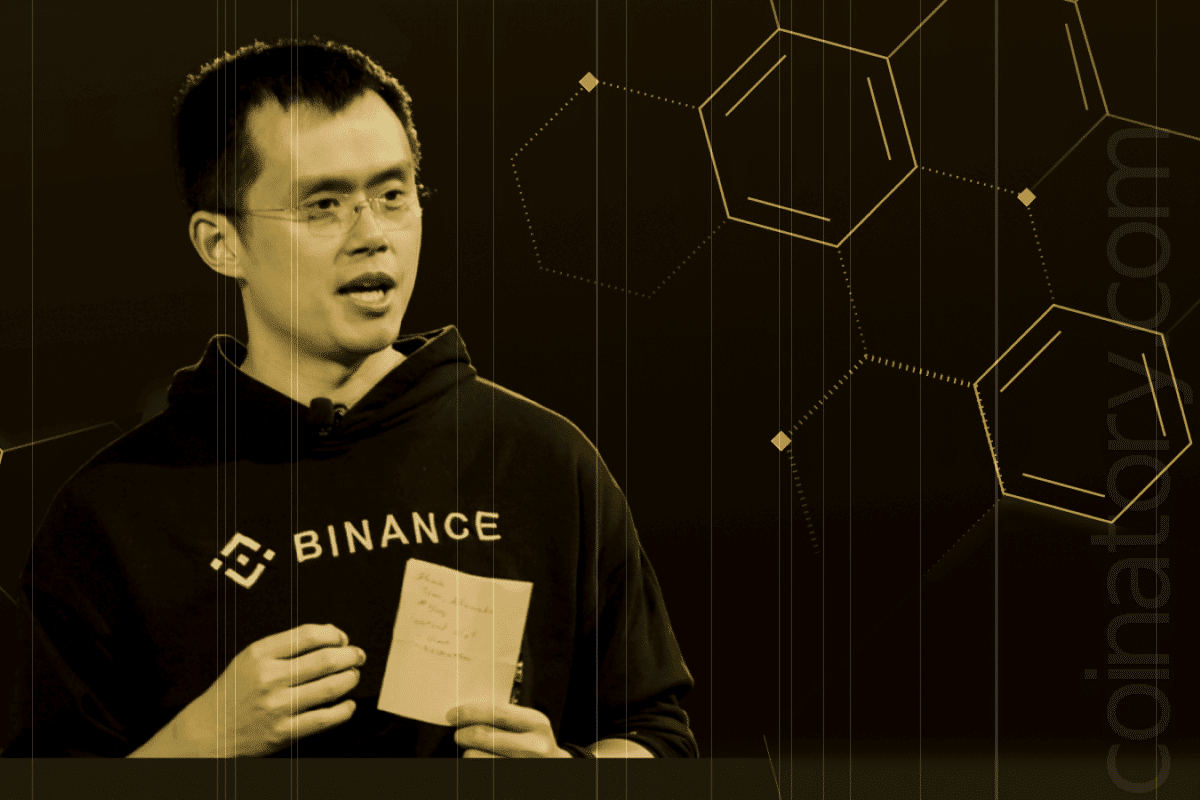

According to Binance’s CZ, governments should adopt blockchain technology to increase transparency in public spending.

Changpeng Zhao (CZ), a co-founder of Binance, has urged all countries to use blockchain technology to track public expenditure as the world’s sovereign debt approaches $102 trillion. CZ underlined the need of fiscal transparency in a post on X (previously Twitter) on January 25. The tweet read:

“Unpopular opinion: All governments should track all their spending on the blockchain — an immutable public ledger. It’s called ‘public spending’ for a reason.”

This declaration coincides with rumors that Elon Musk and the Department of Government Efficiency (DOGE) are working together to investigate blockchain-based solutions that could lower the government deficit in the United States. CZ’s comments have generated a lot of online debate, with proponents of sound money and limited government uniting behind the idea of immutable, onchain tracking as a way to encourage fiscal responsibility.

The Argument in Favor of Blockchain Openness

Public monitoring of government spending has long been a focus, especially as fiscal irresponsibility fuels rising deficits and inflationary pressures. A possible remedy is provided by blockchain, a decentralized and unchangeable public ledger that makes it possible to track expenses in real time and transparently. Supporters contend that this strategy might boost productivity, lessen corruption, and rebuild public institutions’ credibility.

The Causes of Fiscal Inequality

A major change in monetary policy was brought about by the 1971 decoupling of the US dollar from the gold standard. At first, former President Richard Nixon justified his move to temporarily stabilize the dollar by removing its tie to gold. But this action gave governments unrestricted power to print money, which fueled deficits and added to the $36 trillion national debt of the United States.

Over time, this monetary expansion has reduced the dollar’s purchasing power. Governments have financed their budgets through inflationary policies and structural deficits in the absence of the discipline of a fixed monetary supply.

Bitcoin as a Financial Solution

Bitcoin is increasingly seen as a tool for financial transparency and as a hedge against inflation due to its fixed supply constraint. Concerns regarding the sustainability of the country’s fiscal trajectory were raised in May 2023 when the U.S. Congressional Budget Office predicted that yearly deficits would quadruple over the following ten years.

Donald Trump, the former president, has even suggested that Bitcoin may be used to pay down the national debt. He implied in an August 2024 interview that the debt load might be lessened by establishing a Bitcoin strategic reserve. VanEck, an asset manager, backed this idea, calculating that a reserve of this kind might reduce the national debt by 35% in 25 years.

Moving Toward a Future Based on Blockchain

CZ’s demand for blockchain integration in government expenditures reflects an increasing desire for creative answers to budgetary problems as the nation’s debt keeps rising. Governments might usher in a new era of public trust and financial discipline by utilizing the transparency and accountability provided by blockchain technology.