South Africa is emerging as a significant hub for digital assets, driving cryptocurrency adoption through proactive regulations and the growth of platforms such as VALR. According to Ben Caselin, Chief Marketing Officer of Johannesburg-based crypto exchange VALR, several African economies demonstrate strong potential for becoming key digital asset hubs. However, the increasing cost of compliance is reshaping the landscape as regulatory clarity strengthens across the continent.

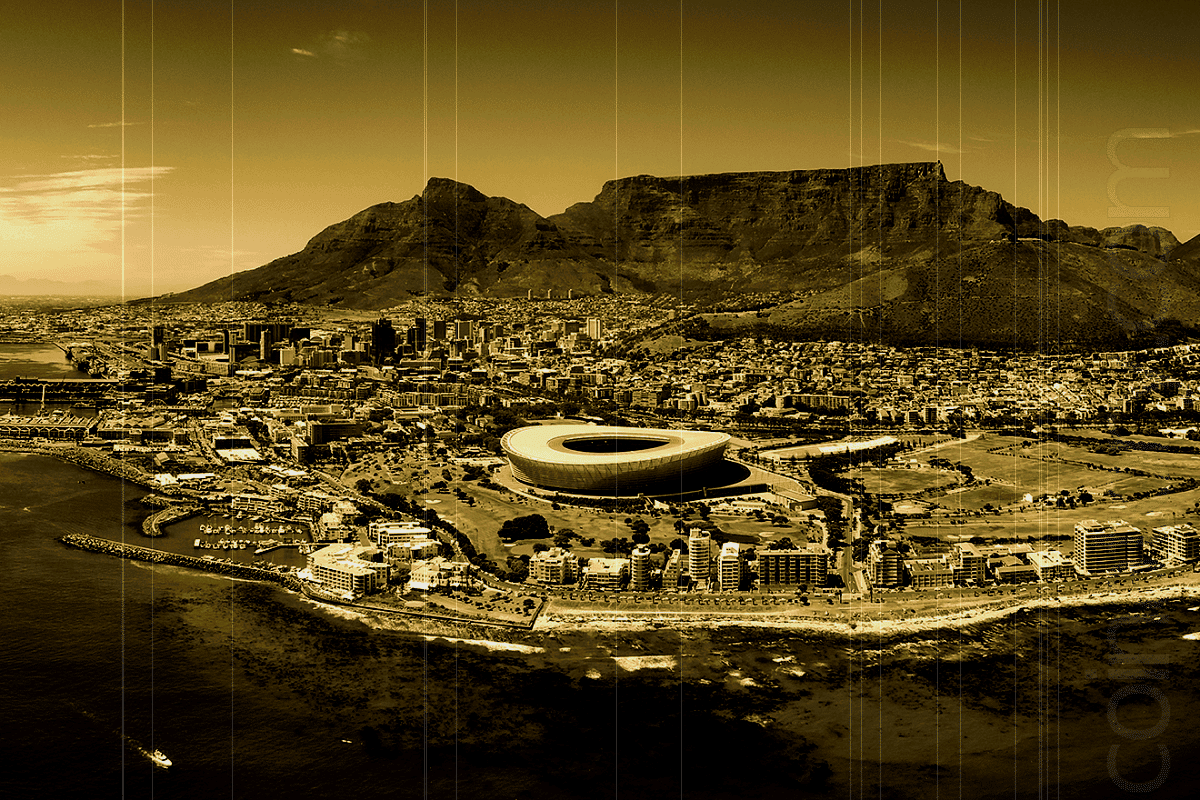

“South Africa serves as the gateway to Africa, offering a robust rule of law and independent judiciary, making it easy to establish a company here,” Caselin said in an exclusive interview with Cointelegraph. He highlighted the country’s favorable business environment, positioning it as a strategic entry point for digital asset platforms.

In April, the Financial Sector Conduct Authority (FSCA) of South Africa issued new Crypto Asset Service Provider (CASP) licenses to VALR. Backed by $55 million in equity funding from investors such as Pantera Capital and Coinbase Ventures, VALR obtained both Category I and II CASP licenses, further solidifying its market presence.

The South African cryptocurrency market is projected to generate $246 million in revenue in 2024, with a compound annual growth rate (CAGR) of 7.86% pushing the market size to $332.9 million by 2028, according to a Statista report.

South Africa’s Regulatory Momentum

In March 2024, South Africa’s FSCA granted licenses to 59 cryptocurrency platforms under existing regulations, with another 262 applications still pending from a total of 355. The country has established itself as the first in Africa to license crypto exchanges, having initiated the development of a dedicated regulatory framework as early as 2021. This move underscores South Africa’s role as a leader in African crypto regulation.

After years of consultation with local market participants and regulators, South Africa’s comprehensive regulatory regime for Crypto Asset Service Providers has matured significantly. Caselin anticipates further clarity around capital controls and definitions, positioning South Africa’s regulatory framework as one of the most advanced globally. “South Africa’s regulatory environment is on par with Dubai and offers more clarity than many regions in Asia, including Hong Kong and Singapore, and certainly more than the United States,” he added.

Despite regulatory advances, the cost of compliance has risen sharply, with VALR significantly increasing its compliance team, now constituting over 10% of its workforce.

A Rising Tech Hub in Africa

Beyond cryptocurrency, South Africa is gaining prominence as an emerging technology hub. In July, a Solana-based marketplace, AgriDex, facilitated a cross-border agricultural trade between a South African producer and a UK-based importer. Using the Solana blockchain, the transaction—covering olive oil and wine—was completed with minimal fees, illustrating the advantages of blockchain technology in traditional industries.

In tandem with advancements in digital assets, South Africa is also establishing itself as a leader in artificial intelligence (AI) regulation. In August, the Department of Communications and Digital Technologies (DCDT) unveiled a national AI policy framework, laying the groundwork for potential AI regulations and legislation.

With over 1,100 corporate and professional investors and more than 850,000 global traders, VALR has emerged as South Africa’s largest crypto exchange by trading volume, with 70% of its activity coming from institutional clients. Caselin expects VALR to continue its growth, projecting a doubling of its user base by year-end, reaching one million registered users.

“South Africa is not only a major player in Africa’s digital asset landscape but also globally, thanks to its progressive regulatory approach and innovative infrastructure,” Caselin concluded.