South Africa’s financial regulators are calling for cryptocurrency companies with overseas headquarters to establish local offices. This move aims to enhance oversight and accountability. A recent study by the Financial Sector Conduct Authority (FSCA) reveals that around 10% of cryptocurrency service providers in South Africa operate their main offices from abroad.

The FSCA points out that since cryptocurrencies were designated as financial products last year, oversight within South Africa has been inadequate. To address this, the agency is urging these companies to set up local operations. The FSCA defines crypto assets as digital representations of value not issued by a central bank but can be traded, transferred, or stored electronically by individuals and legal entities for payment, investment, or other purposes.

The FSCA emphasizes the necessity to tailor or further refine the existing regulatory framework to effectively address the unique risks of crypto assets without significantly hindering innovation.

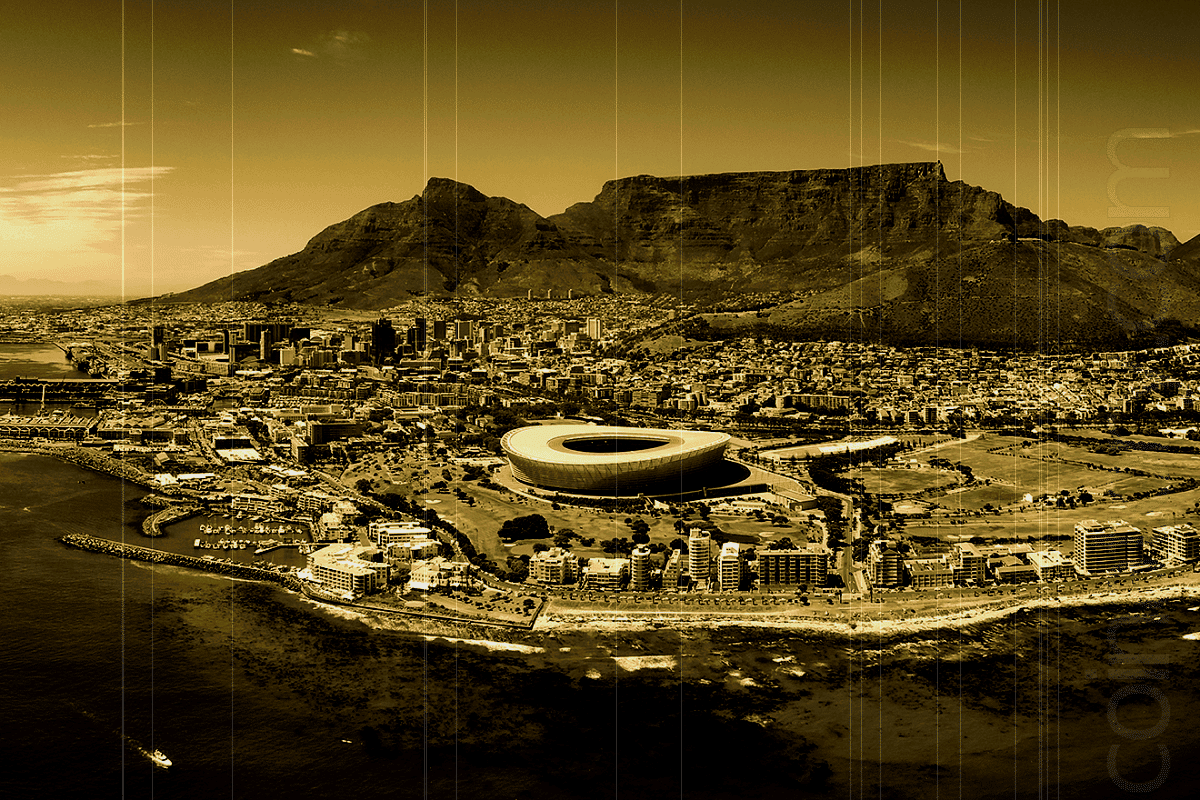

In its Crypto Assets Market Study, the FSCA also highlighted the geographic distribution of crypto startups’ head offices in South Africa, with Cape Town being the most prevalent, followed by Johannesburg, Pretoria, and Durban.

The FSCA notes that crypto asset financial service providers in South Africa primarily generate income through trading fees, mirroring traditional financial revenue models. The study also indicates that the country’s most favored assets offered by crypto startups include unbacked crypto assets and stablecoins.

Earlier this year, the FSCA mandated crypto financial service providers to apply for licenses by the end of November, warning that unlicensed firms will not be permitted to operate in South Africa in 2024. The regulator is currently reviewing around 128 applications and plans to evaluate an additional 36 in December.

South Africa is actively working to distance itself from significant money laundering cases that resulted in the country being closely monitored by the International Financial Action Task Force. The FSCA believes that establishing a regulatory framework for virtual currencies will assist South Africa in avoiding being graylisted by this global financial watchdog.