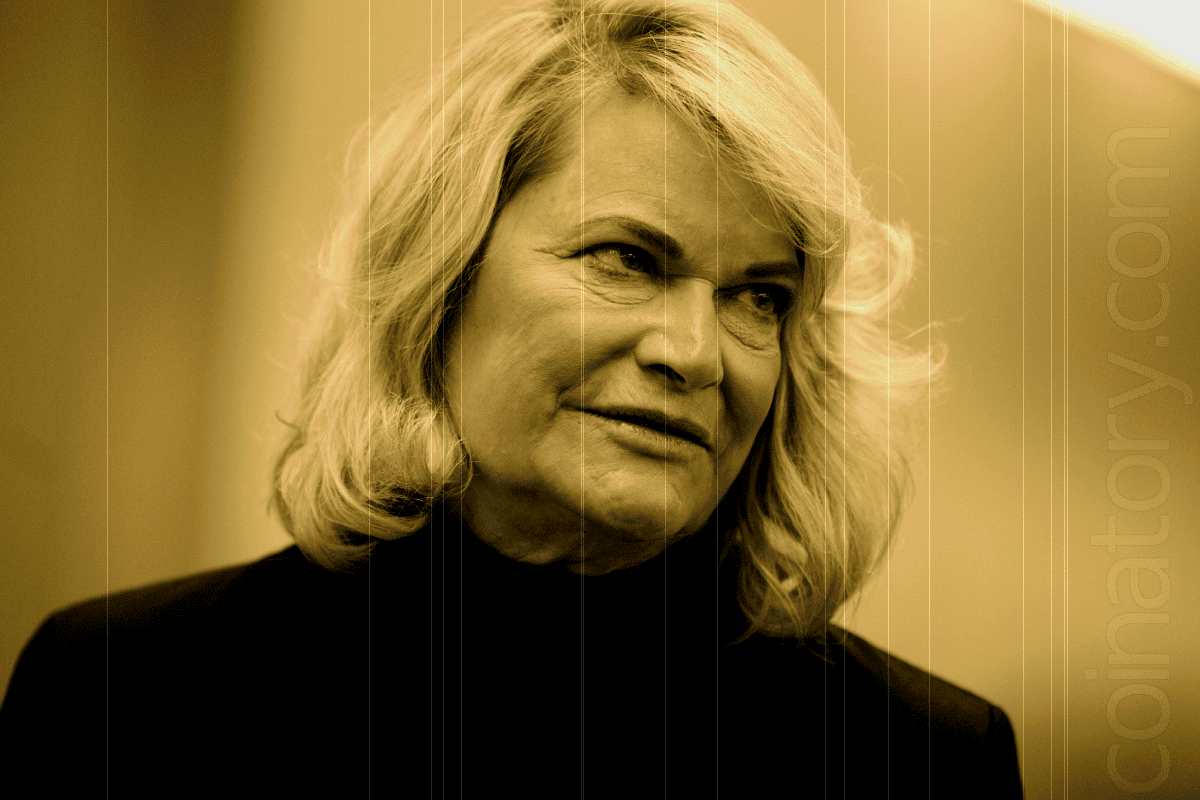

The head of the Senate Banking Committee, Senator Rick Scott, has named Senator Cynthia Lummis of Wyoming as the chair of the Senate Banking Subcommittee on Digital Assets. It is anticipated that Lummis’ leadership would influence important laws and regulatory supervision in the field of digital assets.

Important Goals for the Subcommittee

Lummis listed the subcommittee’s two main objectives:

The focus is on comprehensive digital asset legislation, which includes provisions for a U.S. Bitcoin strategic reserve, unambiguous stablecoin regulations, and a measure pertaining to market structure.

Federal Supervision of Regulatory Organizations: preventing regulatory overreach and ensuring that federal agencies operate within their bounds.

Senator Lummis underlined how crucial such legislation is to preserving American leadership in financial innovation on a worldwide scale. Congress must swiftly enact bipartisan legislation creating a complete legal framework for digital assets that fortifies the US dollar with a strategic Bitcoin reserve if the US is to continue to lead the world in financial innovation, she said.

Bitcoin Strategic Reserve Gain Traction Rumors

The announcement made by Lummis has increased conjecture regarding the creation of a strategic reserve for Bitcoin. Lummis’ appointment, according to former Binance CEO Changpeng Zhao, is a clear sign that a U.S. Bitcoin reserve is “pretty much confirmed.”

Legislation pertaining to Bitcoin reserves has already been introduced in a number of states, including Wyoming, where Lummis is from, Texas, Ohio, New Hampshire, and Pennsylvania.

In a recent blog post, Coinbase CEO Brian Armstrong also called on nation-states to build up Bitcoin reserves, likening the cryptocurrency’s potential to gold as a fundamental global asset. During a cryptocurrency session at the World Economic Forum in Davos, Armstrong restated his stance, highlighting the enduring significance of a U.S. Bitcoin reserve despite the market’s shifting focus.

Economic considerations and skepticism

The idea of a Bitcoin strategic reserve is not seen favorably by everyone. According to Ki Young Ju, CEO of CryptoQuant, the state of the US economy could make such a move more difficult. Since federal politicians continue to prioritize retaining the dominance of the U.S. dollar, Ju contended that a position of economic strength could lessen the chance of adopting Bitcoin reserves.

Also, economists predict that if the U.S. dollar strengthens in international markets, former President Donald Trump’s pro-Bitcoin stance may falter, which may make bipartisan support for legislation centered on cryptocurrencies more difficult.