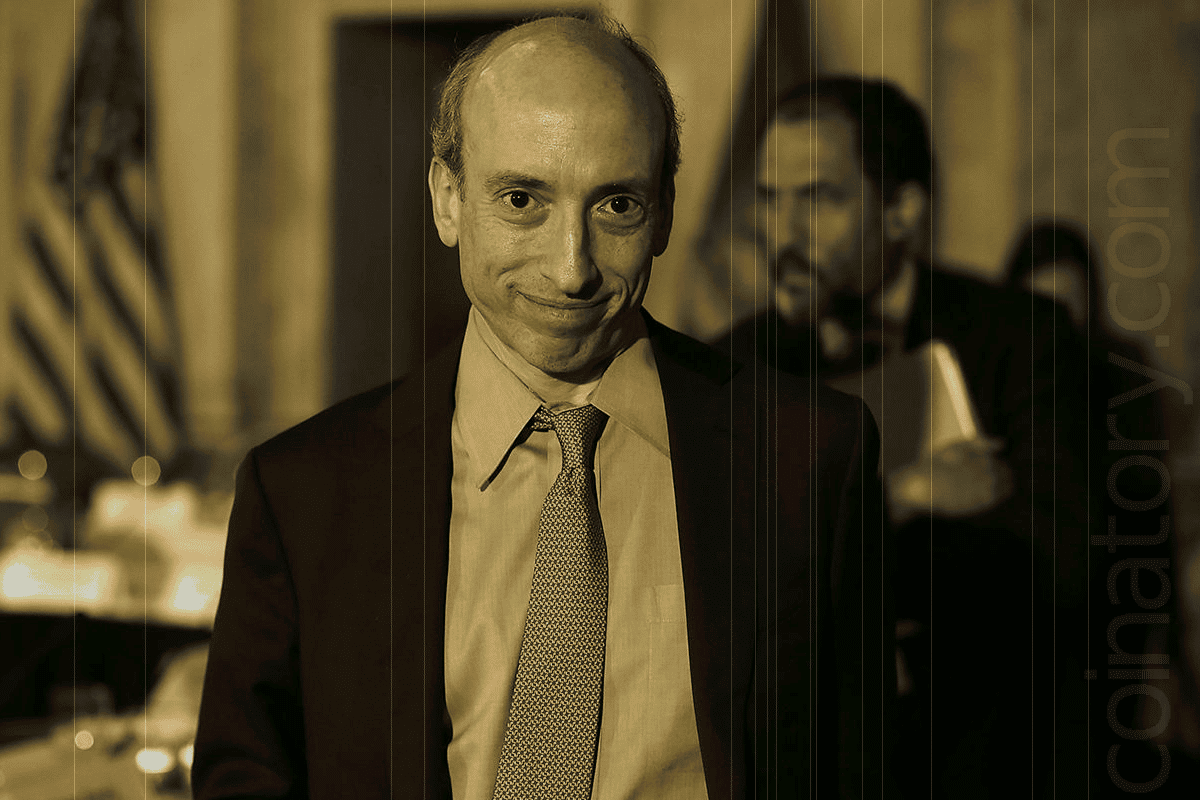

U.S. Senator Bernie Moreno referred to former Securities and Exchange Commission (SEC) Chairman Gary Gensler as “one of the stupidest people in government” in a scathing attack that reflected the mounting annoyance in the digital asset market. The remark highlights growing business and political dissatisfaction with the SEC’s prior crypto regulation approach. It was delivered during a recent congressional meeting with incoming SEC Chair Paul Atkins.

Moreno, who became well-known across the country for opposing Senator Elizabeth Warren’s anti-crypto efforts in Ohio, was not shy about sharing his opinions about Gensler’s leadership. His comments are in line with the general complaint that Gensler’s tenure at the SEC put needless restrictions on the cryptocurrency industry.

Regulatory Change and Political Pressure

Gensler resigned soon after the 2024 U.S. presidential election, when former President Donald Trump promised to fire him on the first day of a new government at a significant Bitcoin conference. After Trump won the election, Gensler kept his word and announced his resignation in November. Since then, he has been replaced by Paul Atkins, a former SEC Commissioner renowned for his more pro-market views.

A Time of Clarity Over Enforcement

Gensler’s vigorous enforcement-driven regulation strategy during his tenure at the SEC garnered harsh criticism from cryptocurrency advocates. Leaders in the industry argued that the SEC, under his direction, had not set clear regulations or offered practical advice to businesses in the sector. Rather, the agency’s dependence on litigation created a regulatory ambiguity that hindered innovation and led a number of businesses to look for more advantageous environments outside.

Claims of Preference for Conventional Finance

Additionally, Gensler came under fire for allegedly favoring well-known banks like JPMorgan Chase over up-and-coming blockchain companies. During the SEC’s well-publicized prosecution against Ripple, which many in the cryptocurrency community saw as representative of a larger effort to thwart industry advancement, these charges acquired further traction.

Persistent Repercussions in the Crypto Community

The remarks made by Senator Moreno are indicative of a growing discussion over the most effective way to control digital assets. Many in the cryptocurrency community have voiced their optimism that the SEC will change course and adopt a more constructive and balanced framework that protects investors and encourages innovation under the new administration.

The consequences of Gensler’s tenure—and its alleged flaws—are probably going to continue to play a significant role in shaping U.S. crypto policy going forward as regulatory perspectives change and the political environment changes.