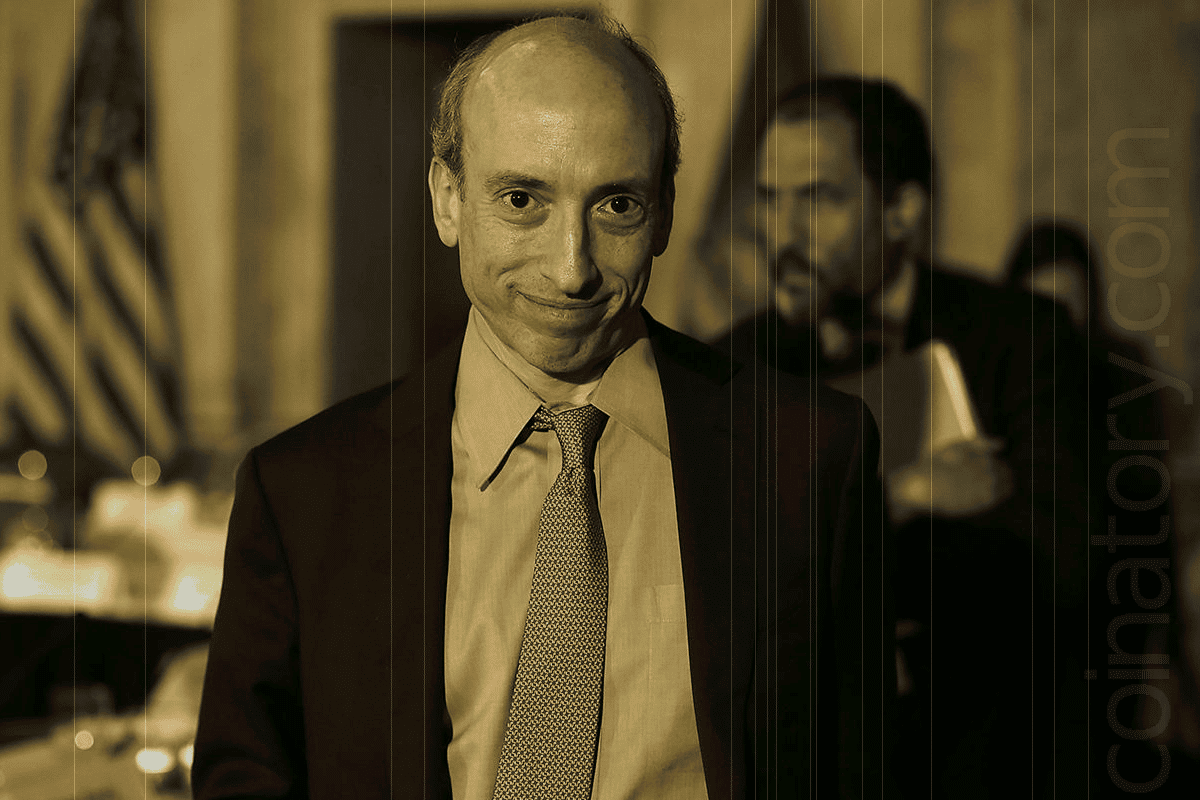

SEC Chairman Gary Gensler has recently issued a series of cautions regarding cryptocurrency investments, coinciding with major financial institutions applying for Bitcoin ETF approval, indicating heightened regulatory attention.

Gensler, in a recent Twitter thread, cautioned potential crypto investors to be aware of the risks and the regulatory framework. He highlighted that those offering crypto asset investments or services might not be complying with the law, including federal securities laws, potentially leaving investors without crucial information and protections.

Although Gensler’s comments did not directly mention the ongoing Bitcoin ETF applications, their timing, close to major asset managers like BlackRock, ARK 21Shares, VanEck, and others submitting amended S-1 forms, was notable. This is seen as a possible final step before SEC approval. The SEC’s decision depends on the amended 19b-4 forms submitted by exchanges such as Nasdaq, NYSE, and CBOE. Approval would allow trading to begin alongside the S-1 forms’ effectiveness. A decision is expected soon, especially given the January 10 deadline for the SEC’s response to applications from firms like Cathie Wood’s ARK Investment and 21Shares.

Despite the anticipation over the decision, Gensler’s remarks haven’t provided clear insights into his view on Bitcoin ETFs. However, some speculate that his general warnings about crypto investing might suggest imminent approval for Bitcoin ETFs.