Norwegian regulators are poised to implement a new legislative framework specifically targeting data centers, including those engaged in cryptocurrency mining operations. This initiative, reported by the Norwegian news outlet VG, will require data centers to formally register and disclose detailed information about their ownership, leadership, and the nature of the services provided. This pioneering legislation will establish Norway as the inaugural European country to impose regulatory measures on the data center sector.

Digitalization Minister Karianne Tung emphasized the strategic intent behind the legislation, stating, “The purpose is to regulate the industry in such a way that we can close the door on the projects we do not want.” The law aims to empower local government officials with enhanced oversight capabilities, thereby improving their ability to make informed decisions concerning the approval or rejection of data center operations.

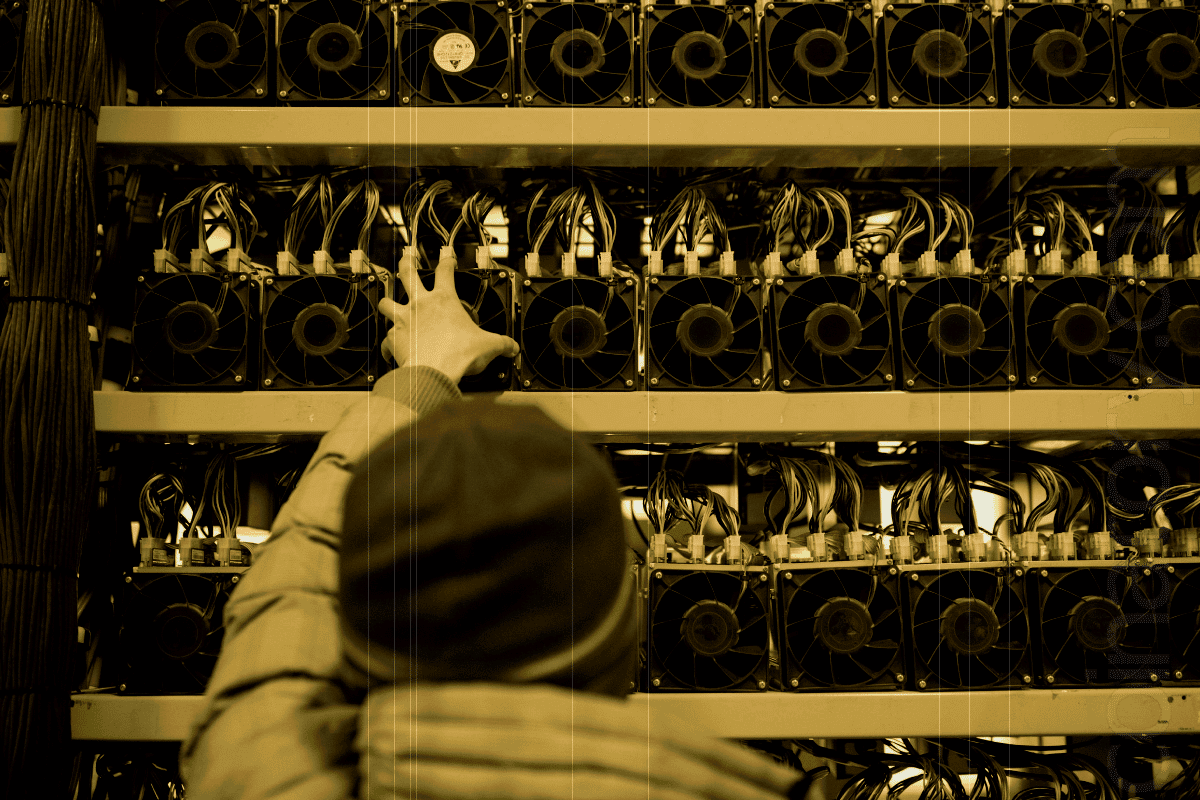

Moreover, the Norwegian authorities have expressed a particular disapproval of cryptocurrency mining ventures due to their environmental impact. Energy Minister Terje Aasland highlighted the significant greenhouse gas emissions generated by such activities, remarking, “It is associated with large greenhouse-gas emissions and is an example of a type of business we do not want in Norway.” This stance reflects Norway’s commitment to environmental sustainability, underscored by its status as Europe’s largest producer of hydropower and a leader in renewable energy utilization.

In recent years, Norway’s low electricity costs, primarily due to its abundant hydropower resources, have attracted numerous cryptocurrency mining companies. A 2023 study indicated that mining operations in Northern Norway used as much electricity as the entire Lofoten district.

The exact number of Bitcoin mining firms currently operating in Norway remains unclear. However, this new legislation will provide greater transparency and support the nation’s broader digitalization objectives, as articulated by Minister Tung.

This regulatory move arrives at a time when the global crypto-mining industry is experiencing a downturn, with notable declines in the stock values of major mining corporations such as Marathon Digital Holdings and Riot Platforms.

Additionally, the impending Bitcoin halving event this week is set to have significant financial implications for the industry. Markus Thielen, Head of Research at 10x Research, predicts that Bitcoin miners might need to liquidate approximately $5 billion worth of the cryptocurrency to stay afloat post-halving.