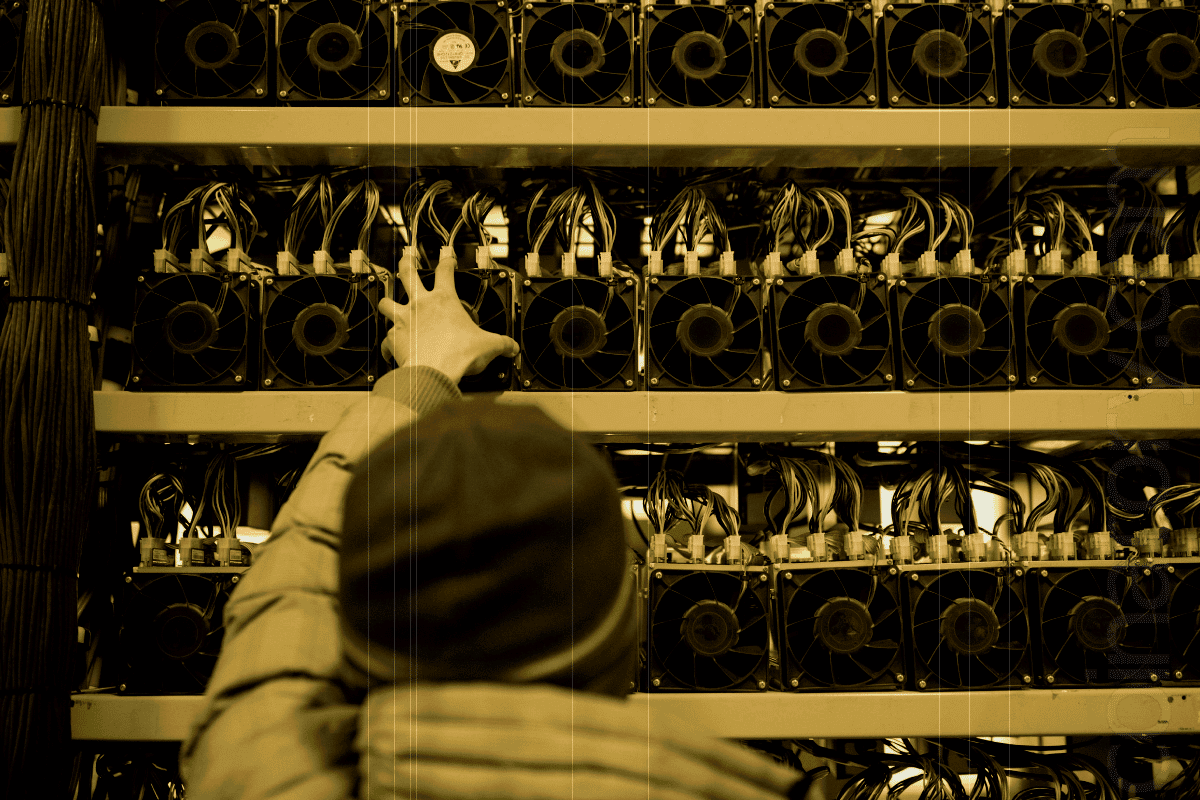

With more than 40% of the hashrate on the worldwide Bitcoin network by the end of 2024, the US has become a major player in the mining industry. This indicator, which shows the overall amount of processing power protecting the Bitcoin protocol, highlights America’s expanding dominance in the cryptocurrency mining sector.

Pool Drive at MARA and Foundry USA Hashrate for the US

Together, Foundry USA and MARA Pool, two US-based mining pools, accounted for 38.5% of all blocks mined worldwide in 2024. The hashrate of Foundry USA increased from 157 exahashes per second (EH/s) in January to about 280 EH/s by December, indicating a notable rise in processing power. With 36.5% of the Bitcoin network’s total hashrate, Foundry USA is now the biggest mining pool.

According to the Hashrate Index, MARA Pool contributes a noteworthy 32 EH/s, or 4.35% of the overall hash power, despite being smaller.

China’s Persistent Impact

The majority of the global hashrate is still controlled by Chinese mining pools, notwithstanding American dominance. According to a 2024 research by CryptoQuant, Chinese miners continue to account for 55% of the worldwide Bitcoin hashrate. This is true even though cryptocurrency operations are prohibited nationwide in China as of 2021.

Through peer-to-peer apps and virtual private networks (VPNs), Chinese miners frequently get around official regulations to access mining pools and exchange cryptocurrencies outside of the purview of governmental regulation.

The Debate Over Decentralization Heats Up

Concerns regarding Bitcoin’s decentralization have been raised by the growing hashrate concentration in a small number of mining pools. The CEO of Auradine, a company that makes mining chips, Rajiv Khemani, underlined in October 2024 how important decentralization is to Bitcoin’s robustness and neutrality.

According to Khemani, the integrity and security of Bitcoin are seriously jeopardized by dependence on centralized mining infrastructure or jurisdictional concentration. In order to avoid supply chain vulnerabilities, he promoted diversifying the production of vital mining equipment, such as application-specific integrated circuits (ASICs).

Complexity of Geography in Hashrate Measurement

The geographical dispersion of miners makes it more difficult to quantify hashrate supremacy precisely, according to TheMinerMag. Mining pools that depend on contributions from miners all across the world may have their headquarters in one nation. The argument about hashrate centralization becomes more complicated as a result of this decentralized involvement, which blurs the boundaries of jurisdictional control.