In an extraordinary turn of events, shares of BTC Digital Ltd. (NASDAQ: BTCT), a nano-cap Bitcoin mining company, surged 316.67% in a single trading session on November 12, 2024. The stock jumped from a previous closing price of $2.52 to $10.50, peaking at $17 mid-session before settling at $10.50. The rally extended BTCT’s upward trend, which continued to hold despite a 15.43% drop in pre-market trading on Wednesday, stabilizing the stock at $8.88.

What Drove BTC Digital’s Sudden 300% Gain?

The origins of BTCT’s remarkable climb remain ambiguous. BTC Digital has faced a prolonged decline in market valuation, with shares plummeting 99.88% since its 2020 peak. This dramatic fall had largely relegated the stock to obscurity, making the Tuesday rally all the more unexpected and speculative.

The company’s low market capitalization, just over $27 million, likely played a role in the stock’s volatility. Low-cap stocks are often subject to extreme price fluctuations, as even limited investor interest can trigger substantial price shifts. This susceptibility to volatility, combined with recent enthusiasm surrounding Bitcoin, may be a key driver behind BTCT’s resurgence.

Could Bitcoin’s Rally Be the Catalyst?

The broader cryptocurrency market, especially Bitcoin, has been on a significant rally since the November 2024 election. Bitcoin, for example, surged 27.17% from $69,000 to $87,747 between November 5 and November 13, nearing its all-time highs of nearly $90,000. Year-to-date, Bitcoin’s price has risen a remarkable 90.64%, reaching new record levels after Donald Trump’s reelection.

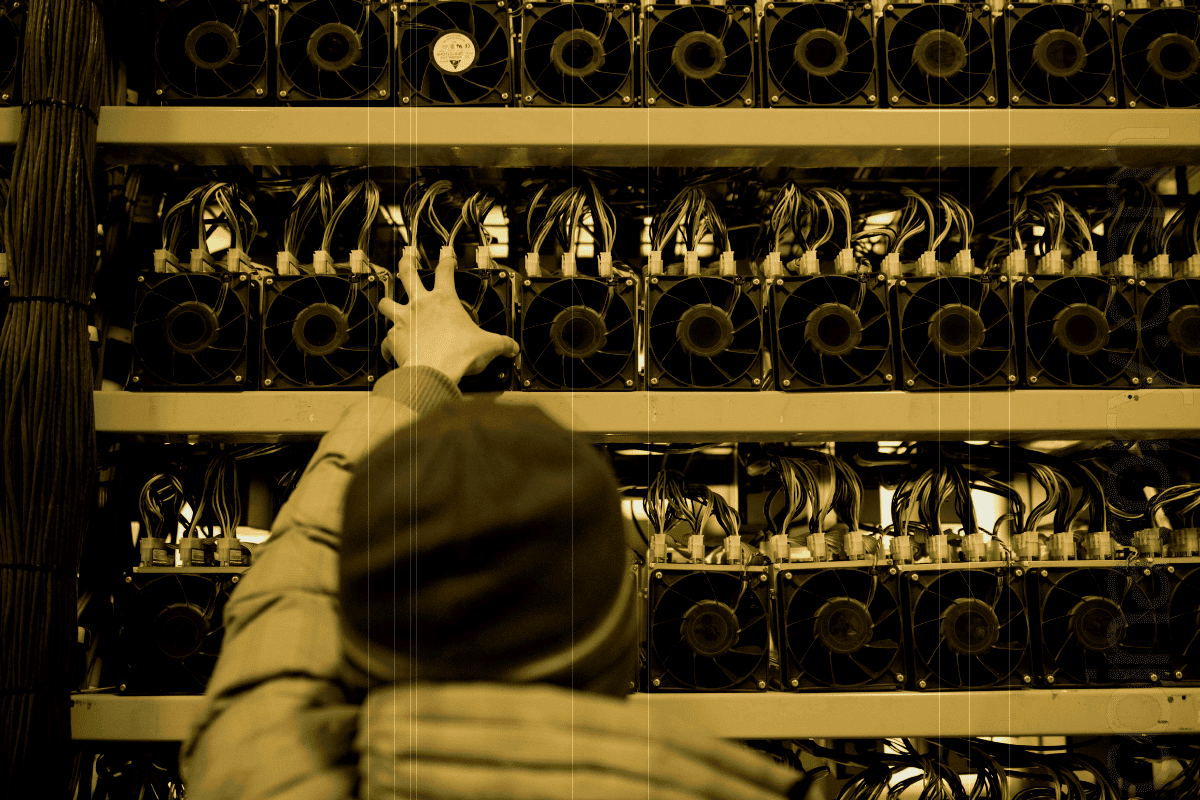

This sustained strength in Bitcoin has likely fueled increased investor interest in related assets. With BTCT positioned as a Bitcoin mining firm, its stock may have captured speculative attention amid Bitcoin’s upward momentum. Additionally, given BTC Digital’s near penny-stock valuation, it wouldn’t require significant trading volume to propel the stock to such dramatic gains.

Outlook for BTCT and the Bitcoin Mining Sector

While the rally in BTCT’s stock was impressive, the durability of these gains remains uncertain. The absence of a clear catalyst raises questions about the sustainability of BTCT’s price, especially if Bitcoin’s broader rally falters. Investors should exercise caution, given the high volatility inherent in both nano-cap stocks and cryptocurrency-exposed equities.