As of March 25, 2025, the Bitcoin network’s computational power, or hashrate, has reached 837 exahashes per second (EH/s), approaching its all-time high. This surge aligns with Bitcoin’s price increase to approximately $87,475, marking a 5.03% rise over the past week. hashrateindex.com

The uptick in Bitcoin’s value has positively impacted miners’ earnings. The hashprice, representing the expected revenue per petahash per day, has risen to $48.80, a 2.54% increase from the previous week’s $47.59.

Mining difficulty, a measure of the network’s resistance to block discovery, adjusted upward by 1.43% on March 23, 2025, reaching 113.76 trillion. This adjustment reflects the increased hashrate and contributes to maintaining a consistent block production time.

Transaction fees have also seen an increase. Over the past week, miners collected an average of 0.0406 BTC per block in fees, up 14% from the prior week’s 0.0357 BTC. This rise indicates heightened network activity and demand for block space.

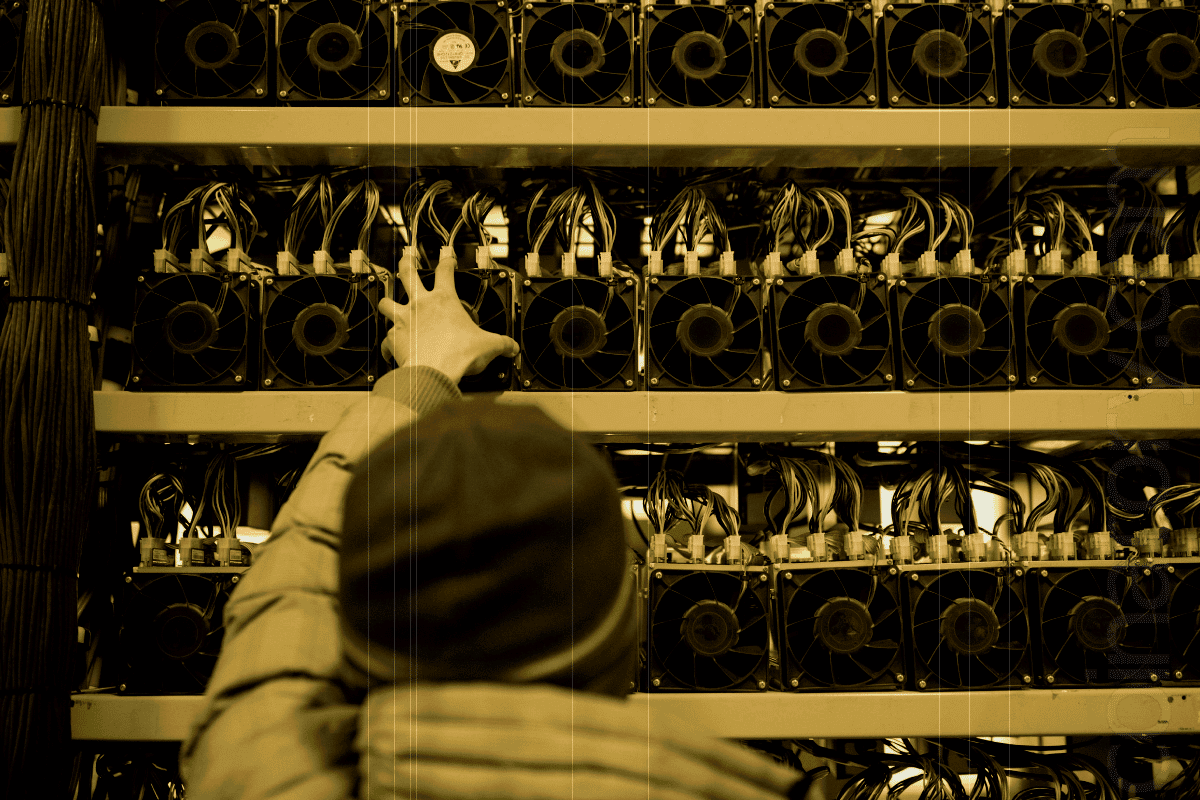

Advancements in mining hardware, such as the introduction of more efficient application-specific integrated circuits (ASICs), have likely contributed to the increased computational output. These developments enable miners to enhance operations and capitalize on favorable market conditions.

In summary, the confluence of Bitcoin’s price appreciation, escalating hashrate, and rising transaction fees has bolstered mining revenues. However, miners must continually adapt to the dynamic landscape, balancing operational costs against earnings amid fluctuating network conditions.