The software firm MicroStrategy, which is well-known for its audacious Bitcoin investments, has revealed a plan to significantly expand the number of its Class A ordinary and preferred stock shares. This will allow the company to continue implementing its ambitious Bitcoin acquisition strategy.

The company wants to raise Class A ordinary shares from 330 million to 10.33 billion and preferred shares from 5 million to 1.005 billion, per a proxy statement submitted to the U.S. Securities and Exchange Commission (SEC). MicroStrategy’s “21/21” strategy, a $42 billion, three-year capital drive to raise $21 billion in equity and $21 billion through fixed-income instruments, such as debt and convertible notes, would be supported by these adjustments.

“The proposals we are asking you to consider reflect a new chapter in our evolution as a bitcoin treasury company and our ambitious goals for the future,” the statement said.

The Bitcoin Strategy That Fuels Long-Term Development

The 21/21 plan from MicroStrategy reaffirms the company’s dedication to Bitcoin as a key treasury asset. The company’s aggressive acquisition approach is demonstrated by its most recent purchase of 5,262 BTC for over $561 million. With this, its total Bitcoin holdings now stand at 444,262 BTC, which is worth more than $41.6 billion.

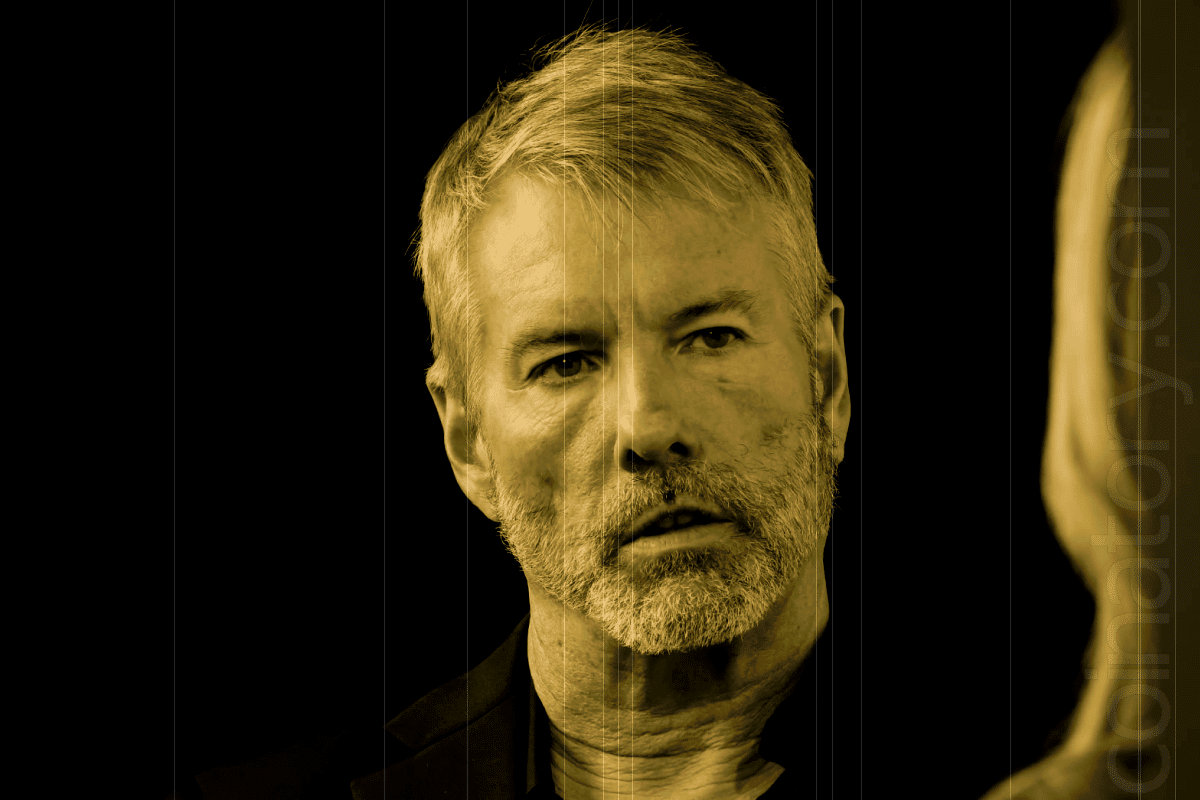

Since 2020, Bitcoin supporter and co-founder Michael Saylor has pushed for this approach, designating Bitcoin as MicroStrategy’s main treasury reserve. The firm is the biggest corporate owner of Bitcoin worldwide thanks to its substantial holdings.

New Incentive Plans and Governance Changes

MicroStrategy has unveiled a new equity incentive plan in conjunction with its proposed share increase, which aims to automatically allocate shares to new directors. This endeavor is in line with the board’s recent addition of three new members:

- Brian Brooks, former CEO of Binance (2021).

- Jane Dietze, board member at Galaxy Digital since 2022.

- Gregg Winiarski, known for his corporate governance expertise.

With these appointments, the board now has nine members instead of only six, indicating a more robust leadership team to help the company achieve its lofty objectives.

The Performance of Stocks Indicates Volatility

The stock of MicroStrategy has performed inconsistently in spite of its dedication to Bitcoin. Shares dropped 8.78% to $332.23 on Monday after the news of its most recent Bitcoin acquisition was released, representing a 17.6% drop over the previous month. Nonetheless, the stock has increased by 450% in the last 12 months, indicating that investors are confident in its long-term outlook.