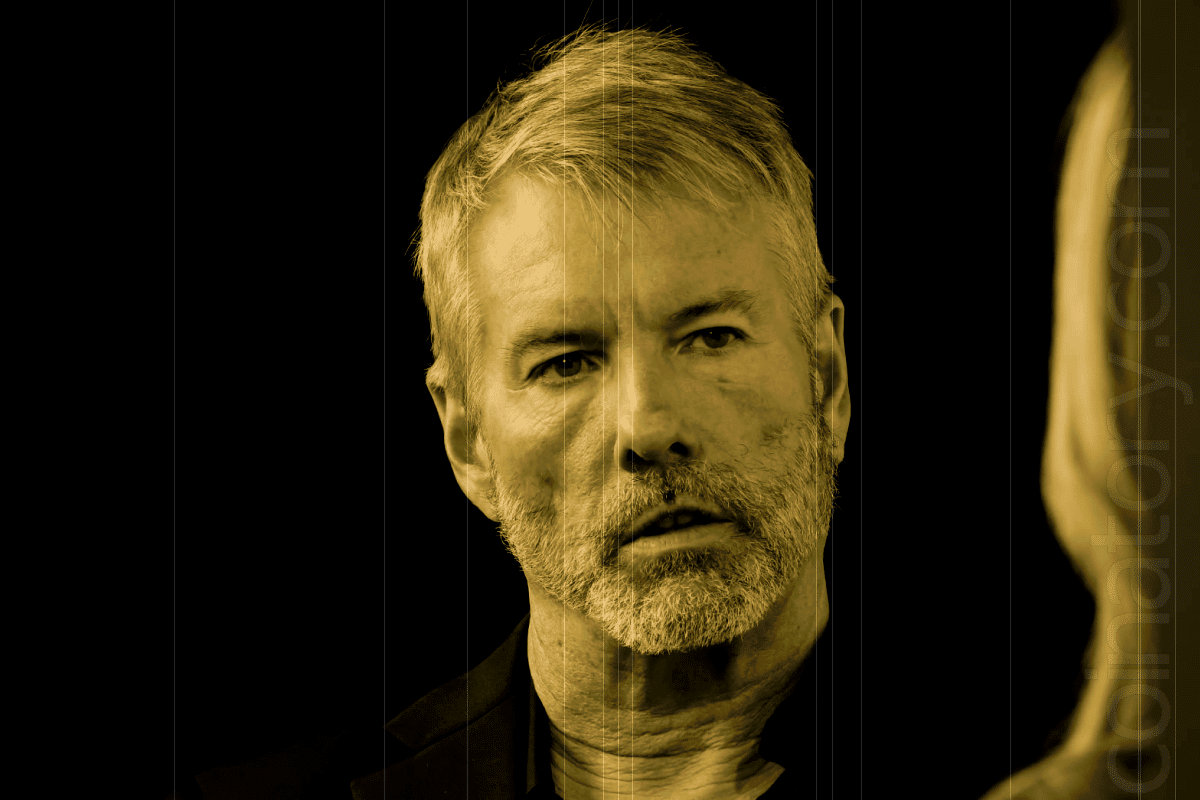

MicroStrategy Initiates Discussion With $40 Billion Bitcoin Bet

Under the mysterious leadership of its chairman, Michael Saylor, MicroStrategy has amassed an incredible $40.01 billion in Bitcoin holdings. Industry observers continue to criticize the company’s aggressive accumulation strategy, even if it recorded an exceptional unrealized gain of 70.35% ($16.52 billion).

In a recent interview with the All-In Podcast, managing partner and CIO of Atreides Management LP Gavin Baker expressed doubts on the viability of Saylor’s Bitcoin-centric strategy. The fact that MicroStrategy bought 402,100 BTC using a debt-heavy approach raises concerns about the company’s long-term sustainability.

Juggling Risk and Growth

Baker drew attention to the growing disparity between MicroStrategy’s $400 million yearly income and its growing interest costs from loans backed by Bitcoin.

“No trees grow to the sky,” Baker remarked, warning that an over-reliance on debt could erode investor confidence.

He expressed concerns about what he called a “magic money creation machine” that would implode if MicroStrategy’s Bitcoin holdings surpass the company’s primary operational capabilities. Baker emphasized that dangers associated with excessive collateralization could endanger financial stability, especially if markets move against Bitcoin.

Saylor Continues on

The warnings don’t change Michael Saylor’s resolve. He reaffirmed his conviction that Bitcoin is a long-term capital asset in a recent interview with Yahoo Finance.

“Every day for the past four years, I’ve said buy Bitcoin, don’t sell Bitcoin. I’m going to be buying more Bitcoin. I’m going to be buying Bitcoin at the top forever,” Saylor emphasized.

He dismisses worries about short-term market volatility and supports tactics like dollar-cost averaging and long holding periods, ideally ten years or more.

Saylor further supported his strategy by highlighting how it affects shareholder value. He claimed, pointing to the company’s noteworthy profits from its Bitcoin holdings, that “we’re generating massive amounts of shareholder value from holding that digital property.”

A Divisive Approach in the Face of Record Bitcoin Prices

The controversy over MicroStrategy’s Bitcoin-focused strategy coincides with Bitcoin’s record high of $103,900, which feeds both skepticism and optimism. Critics contend that Saylor’s approach runs the risk of overstretching the company’s financial resources, while advocates see it as innovative.

Investors must balance the possible returns against the substantial risks as MicroStrategy’s Bitcoin wager comes under increasing scrutiny.