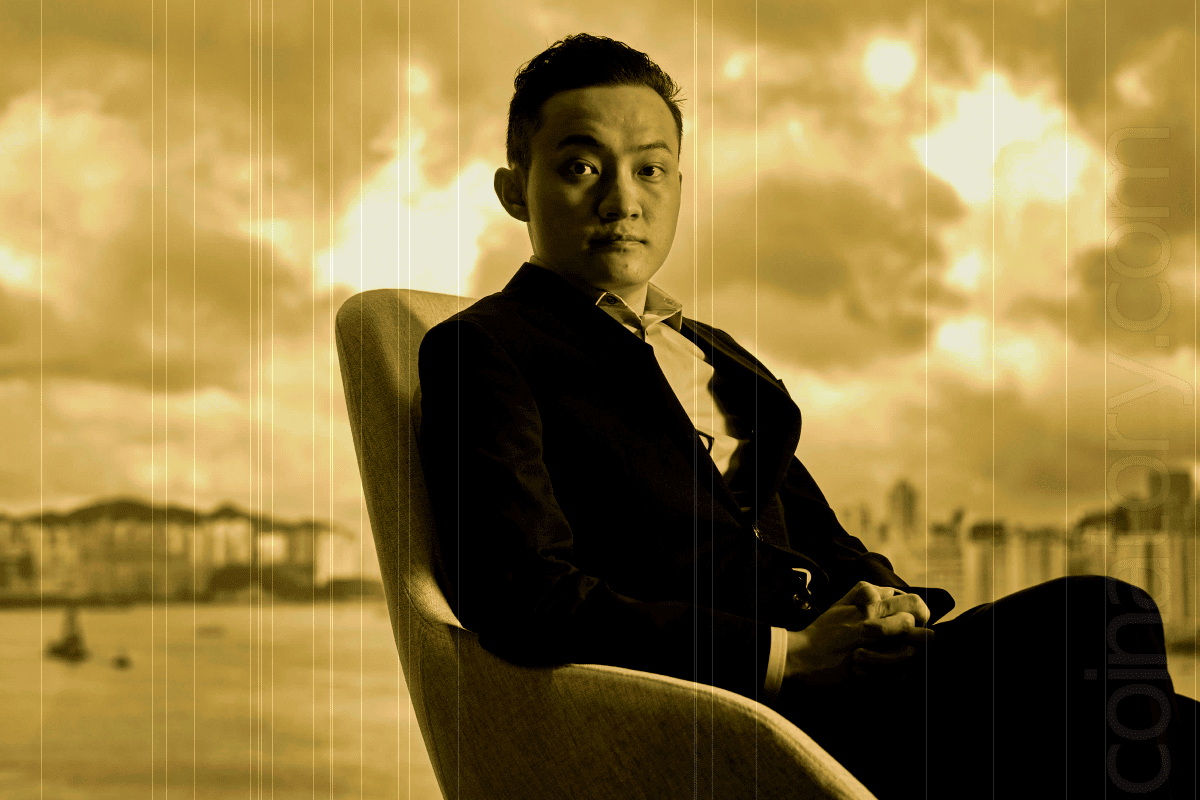

Tron founder Justin Sun has confirmed his attendance at a private dinner hosted by President Donald Trump on May 22, 2025, at Trump National Golf Club in Virginia. Sun qualified for the event by holding the largest stake in the $TRUMP memecoin—reportedly amounting to more than $19 million.

The dinner is part of a broader promotional effort surrounding the $TRUMP token, a digital asset introduced earlier this year. The top 220 holders were granted invitations, while the top 25 are also expected to attend a private VIP reception and exclusive tour with the president. Sun claimed control of the top wallet on the token leaderboard under the username “Sun.”

This announcement further entrenches Sun’s involvement in ventures aligned with Trump’s political and financial interests. Beyond memecoins, Sun has invested $75 million into World Liberty Financial, a decentralized finance platform associated with Trump’s sons. This includes a $30 million investment made shortly after the 2024 U.S. presidential election. Sun also serves as an adviser to the platform.

His presence at the dinner comes at a politically charged moment. In 2023, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Sun for alleged unregistered offerings and manipulative trading practices. However, in February 2025, the SEC and Sun jointly filed a motion to stay the case, which was approved by a federal judge.

Sun’s crypto engagements have stirred ethical concerns on Capitol Hill. Several lawmakers, particularly from the Democratic Party, have voiced fears that such initiatives might allow high-net-worth individuals—potentially foreign nationals—to gain disproportionate influence over U.S. policymaking.

The controversy has spilled into the legislative arena, where the GENIUS Act—a bill aimed at regulating stablecoins—has faced delays due to links between Trump-affiliated crypto projects and regulatory oversight. Despite the backlash, the Senate advanced the bill with a 66-32 vote on May 19.

With the $TRUMP token blending digital finance with political access, calls for regulatory scrutiny have intensified. As crypto continues its push into mainstream finance and governance, the convergence of private capital, political influence, and digital innovation underscores the urgent need for comprehensive regulation.