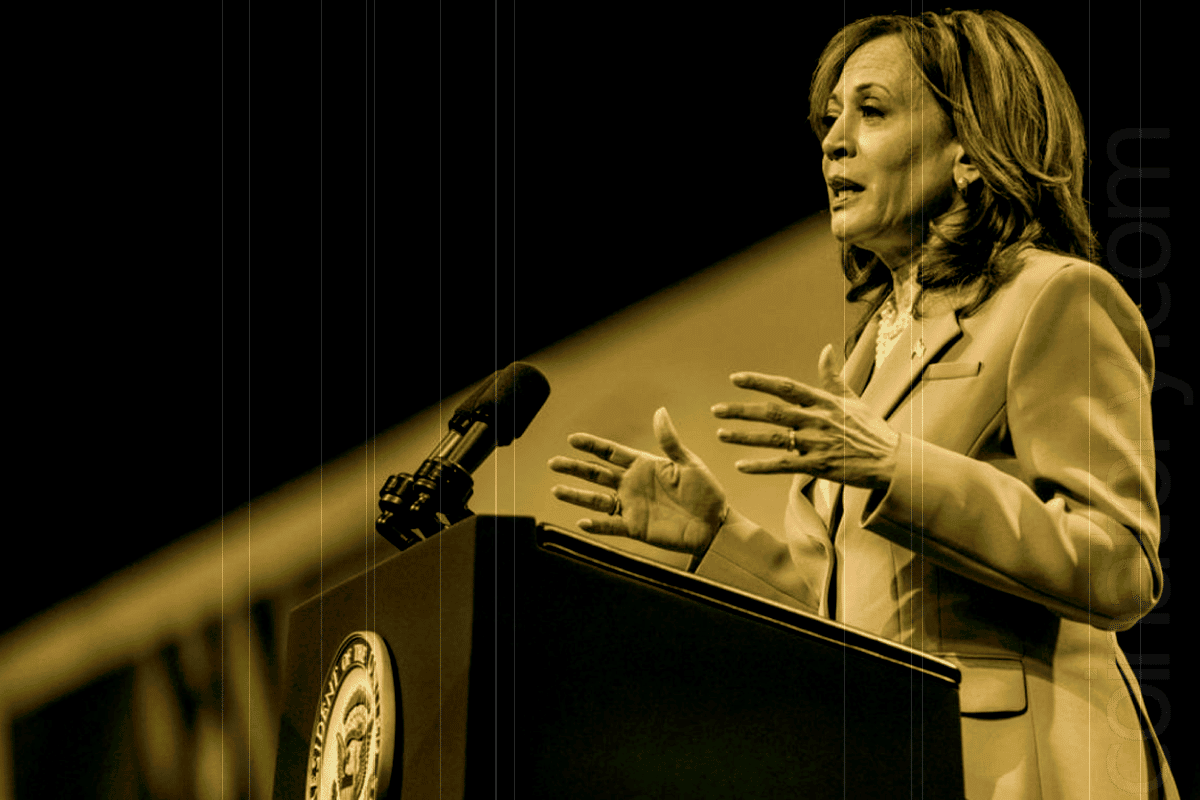

Democratic nominee Kamala Harris has narrowed Republican rival Donald Trump’s lead on blockchain-based betting platform Polymarket, signaling heightened uncertainty as Election Day looms.

Polymarket’s odds for Trump remain significantly above mainstream polling figures, yet Harris has gained traction in recent days. On this marketplace, users speculate on outcomes by purchasing “shares” tied to a specific result, with each share worth USDC 1 if the outcome materializes. A 60-cent price for a “Yes” share on an event suggests a 60% likelihood of it occurring, based on market interpretation.

Harris’s election odds on Polymarket surged to over 44 cents per share ahead of Tuesday’s vote count, up from 33 cents on October 30. Trump’s shares dropped concurrently from 66 cents to 55 cents. Meanwhile, data from Real Clear Politics shows Trump with a razor-thin polling edge at 48.5% to 48.4%, indicating a highly competitive race.

Market activity has also intensified. Polymarket recorded an increase in high-value bets, with trades exceeding $10,000 and $100,000 rising markedly over the weekend. Large stakeholders in both Harris and Trump shares have started offloading their positions, possibly locking in profits from recent price spikes.

The uptick in Harris’s odds may reflect a hedging trend, as traders place protective bets on her campaign alongside investments in Trump, according to an analysis by CoinDesk. A review of large trades suggests strategic moves by some participants to mitigate losses if Trump were to underperform on Election Day.

Rising reports of alleged voting irregularities, largely favoring Democrats, have amplified betting volatility. Speculation around potential “voter fraud” on social media could be influencing these shifts, as rumors continue to circulate on platforms like X. Influential political bettor ‘Domer’ weighed in on these developments on Sunday, assigning Harris a 55-60% chance of winning the presidency, factoring in recent polling data and early voting behaviors.

In addition, demographic trends in early voting have shown an unusual Republican turnout. This trend, if indicative of strategic changes, may suggest a shift in voter behavior that traditional polls have struggled to capture.

Finally, post-2020 election analysis shows that Republicans have underperformed expectations in recent cycles despite President Joe Biden’s low approval ratings. This disconnect between polling and outcomes may be pushing traders on Polymarket to account for broader, less predictable voting sentiments.