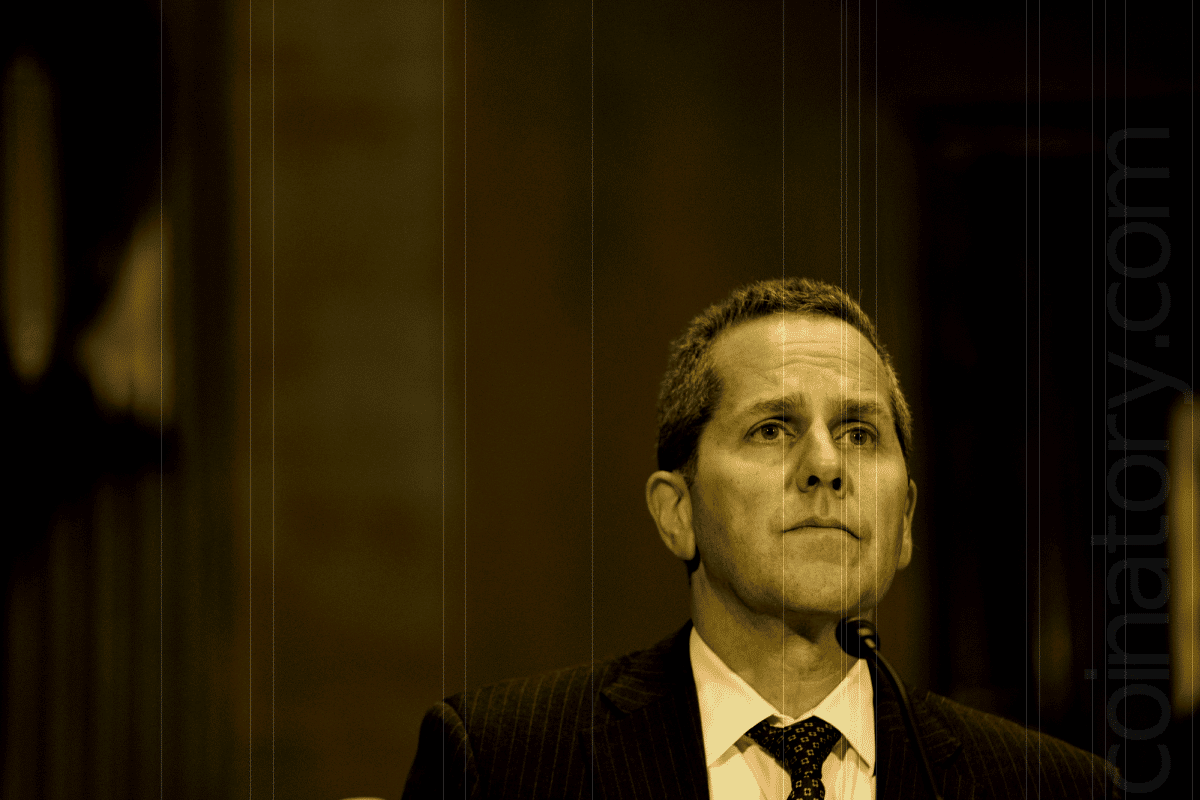

Michael Barr, the Federal Reserve’s Vice Chair of Supervision, emphasized the need for robust stablecoin regulations within the United States aimed at investor protection and establishing safeguards to tackle current challenges.

During his address at the 7th Annual D.C. Fintech Week, Barr highlighted the significant attention that stakeholders are paying to the development of a regulatory framework for stablecoins, which are cryptocurrencies tied to the value of fiat currencies like the U.S. dollar.

Barr remarked that these digital assets leverage the credibility of the Federal Reserve and underscored that private currencies must be subject to stringent regulation. This would enable the Federal Reserve to effectively implement policies and sanction those issuers who comply.

He further mentioned that it is the responsibility of Congress to lay out this regulatory infrastructure and craft clear rules that can be applied by financial regulatory bodies. The House Financial Services Committee has been working on legislation concerning stablecoins, though there have been reservations from policymakers such as Maxine Waters concerning certain elements of the proposal.

One controversial aspect of the proposed bill is the provision for state authorities to have the power to approve stablecoin issuers and their products, a move that Waters suggests might undermine the Federal Reserve’s oversight.

Touching on the topic of a retail central bank digital currency (CBDC), Barr conveyed that the Fed would proceed with developing such a currency only if there is a green light from the White House and Congress. Currently, the Fed is actively involved in research and discussions regarding this issue, as noted by Barr.

He also referenced regulatory advances in other regions, noting that authorities in the UK and Hong Kong have issued their guidelines for stablecoin operators, and the European Union has enacted MiCA, which stands as the first extensive legislative effort by a major economic region to regulate cryptocurrencies and stablecoins.