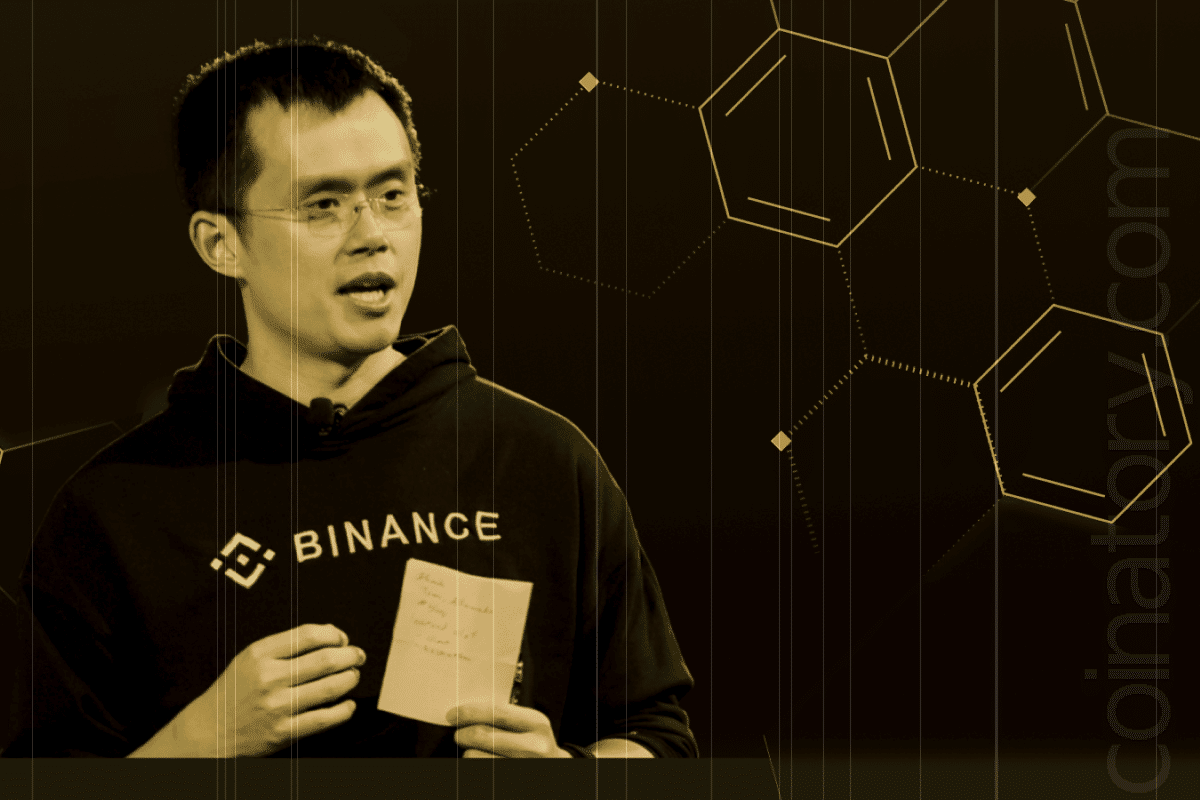

Changpeng “CZ” Zhao, co-founder of Binance, has made a bold prediction for Bitcoin’s trajectory, forecasting a price range of $500,000 to $1 million in the current market cycle. Speaking during a May 5 interview with Rug Radio, Zhao cited the institutional adoption of Bitcoin, especially through spot exchange-traded funds (ETFs), as a major catalyst for the digital asset’s bullish momentum.

“There’s the ETFs. There’s this institutionalization of Bitcoin […] it’s a positive in terms of price action,” Zhao remarked. He emphasized that institutional capital—particularly from the United States—is increasingly flowing into the crypto space via Bitcoin ETFs, significantly influencing the market. According to Zhao, this inflow has been a key factor driving the recent upward movement in Bitcoin’s price, even if altcoins have not followed suit.

Supporting this perspective, Alex Obchakevich, founder of Obchakevich Research, noted that approximately 70% of Bitcoin’s recent price growth is attributable to new institutional capital, while the remainder stems from redistribution within the crypto ecosystem. Obchakevich also acknowledged the influence of ETFs in propelling the ongoing bull trend, albeit with intermittent corrections.

Beyond institutional investors, Zhao pointed to national governments as emerging buyers of Bitcoin. “It’s also very good validation,” he said, highlighting the accumulating reserves of countries such as El Salvador and Bhutan. El Salvador, which first adopted Bitcoin as legal tender in 2021, recently added 7 BTC to its holdings, bringing its total to nearly 6,170 BTC—valued at approximately $580 million.

Similarly, the Kingdom of Bhutan is reportedly building a sovereign crypto reserve, with plans to include Bitcoin and Ether among its strategic assets. This trend underscores a growing recognition among governments of Bitcoin’s potential as a reserve asset.

Zhao also discussed a notable policy reversal in the United States, claiming the country has “pivoted 180 degrees under a pro-crypto president,” referring to the recent election of Donald Trump. He credited the shift for accelerating institutional interest and predicted that other nations will follow the U.S. lead in embracing digital assets.