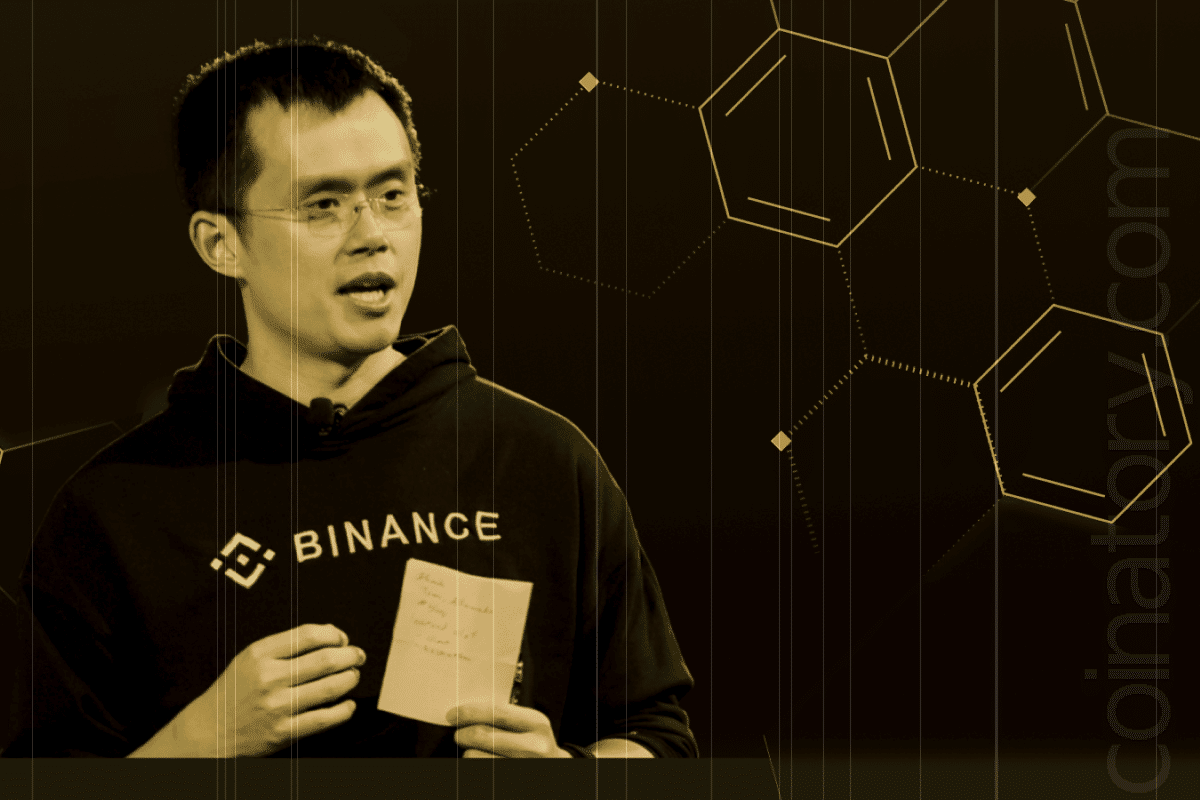

Former Binance CEO Changpeng “CZ” Zhao has expressed sharp criticism of meme coins, advocating for blockchain developers to prioritize projects with tangible utility over hype-driven ventures. In a Nov. 26 post on X (formerly Twitter), Zhao described meme coins as “a little weird,” emphasizing the need for “real applications” that provide practical value.

Meme Coin Hype: Short-Term Gains, Long-Term Risks

CZ’s remarks have reignited discussions around the role of meme coins in the cryptocurrency ecosystem, underscoring their often speculative nature. Meme coins, heavily reliant on viral marketing and social media buzz, can generate short-term profits for investors. However, their lack of real-world applications often results in significant losses for holders once the initial excitement wanes.

Meme Coins and Platform Misuse

Zhao’s criticism comes in the wake of controversies surrounding Solana-based meme coin platform Pump.fun. The platform’s livestream feature, intended to foster engagement, was misused for alarming incidents, including a user threatening self-harm if their token failed to meet a market cap goal. Disturbingly, the individual later shared a video purportedly acting on the threat.

Such incidents highlight the risks of meme coin ecosystems, where the absence of regulatory oversight and the focus on speculative gains can lead to harmful outcomes.

A Broader Industry Critique

Other industry leaders have also taken aim at meme coins. Ripple CEO Brad Garlinghouse has argued that tokens like Dogecoin lack meaningful real-world applications, while Ethereum co-founder Vitalik Buterin criticized celebrity-endorsed meme coins earlier this year. In a June X post, Buterin noted that financialization should serve societal benefits, citing areas like healthcare and open-source software as promising use cases for blockchain innovation.

The Case for Utility-Driven Blockchain Projects

The cryptocurrency industry’s long-term success hinges on utility-focused projects. Examples such as Axie Infinity, which enables income generation through gameplay, and AI-driven tokens like Fetch.ai, which facilitate autonomous machine interactions, demonstrate how blockchain can address real-world problems and revolutionize industries.

Despite the value of utility-driven initiatives, the total market capitalization of meme coins remains significant, reaching $120.27 billion—far surpassing sectors like GameFi ($24.1 billion) and AI-focused tokens ($39 billion), according to CoinGecko data.

Challenges to Industry Trust

The speculative nature of meme coins, coupled with their volatility, undermines trust in the broader cryptocurrency market. A CoinWire study revealed that meme coins promoted on platforms like X often lose 90% or more of their value within three months, fueling skepticism among potential adopters and regulators about the industry’s long-term sustainability.

Conclusion

Zhao’s call for a shift from meme coin speculation to utility-driven innovation reflects a broader industry sentiment. For blockchain technology to achieve its full potential, the focus must remain on creating solutions that offer real-world value, fostering trust and advancing the sector’s credibility.