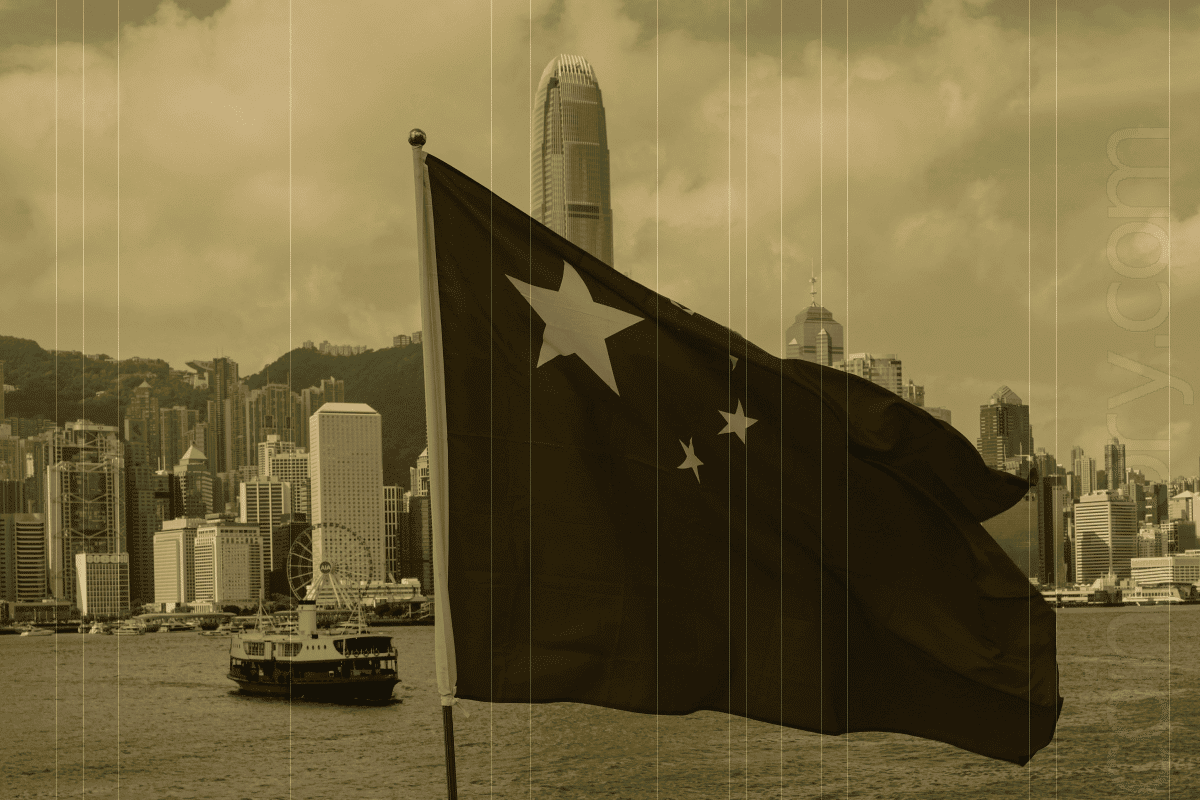

Even as mainland and international regulatory settings grow more stringent, the People’s Bank of China (PBoC) praised Hong Kong’s progress in establishing bitcoin licensing frameworks in its most recent China Financial Stability Report. This honor highlights Hong Kong’s standing as a major center for the development and regulation of cryptocurrencies.

Hong Kong’s Forward-Looking Approach to Crypto Regulations

Hong Kong has become a crypto-friendly environment in spite of China’s stringent prohibitions on cryptocurrency trading. In order to comply with the global requirements for cryptocurrency oversight set forth by the Financial Stability Board (FSB), the city has proactively reinforced its regulatory structure.

Leading these initiatives is the Securities and Futures Commission (SFC) of Hong Kong, which has established a “dual license” framework for the exchange of digital assets. Securitized and non-securitized financial assets are the two supervisory groups into which this system divides virtual assets.

It is now mandatory for major financial institutions like Standard Chartered Bank and HSBC to incorporate virtual asset platforms into their client monitoring procedures. To operate lawfully, cryptocurrency companies also need to obtain licenses from the SFC.

The commission granted licenses to four new exchanges in December:

- Accumulus GBA Technology (Hong Kong)

- DFX Labs

- Hong Kong Digital Asset EX

- Thousand Whales Technology (BVI).

Eric Yip, stated: We have been proactively engaging with VATPs’ senior management and ultimate controllers, which helps drive home our expected regulatory standards and expedite our licensing process for VATPs. We aim to strike a balance between safeguarding the interests of investors and facilitating continuous development for the virtual asset ecosystem in Hong Kong.

Industry Opposition to Tough Requirements

The more stringent regulatory environment has not, however, been without its detractors. Only four of the almost thirty cryptocurrency companies who applied for licenses in 2023 were granted them in December. Prominent platforms with high compliance requirements, including OKX and HTX, pulled their apps. About a dozen candidates are currently awaiting the commission’s judgment.

This discrepancy demonstrates the difficulties Hong Kong has striking a balance between investor protection and innovation. However, its regulatory strategy is a template for other nations attempting to handle the intricacies of bitcoin regulation.