The People’s Bank of China (PBOC), the nation’s central bank, emphasized global efforts to regulate digital assets in its 2024 Financial Stability Report, published on December 27. The report also spotlighted Hong Kong’s initiatives to establish itself as a leader in digital asset regulation with its licensing regime.

Global Digital Asset Regulation Trends

In the report, the PBOC detailed global regulatory developments, noting that 51 jurisdictions have implemented bans or restrictions on digital assets. The central bank highlighted regulatory innovations, including adjustments to existing laws in countries like Switzerland and the United Kingdom, alongside the European Union’s comprehensive Markets in Crypto Assets Regulation (MiCAR).

The report referenced China’s own stringent stance. Since September 2021, the PBOC, along with nine other Chinese regulators, has enforced a ban on digital asset trading via the “Notice on Further Preventing and Managing the Risks of Crypto Trading No. 237.” The directive declared digital assets illegal for trading, with violators facing administrative or criminal penalties. The restrictions extended to prohibiting overseas platforms from providing online services to Chinese residents.

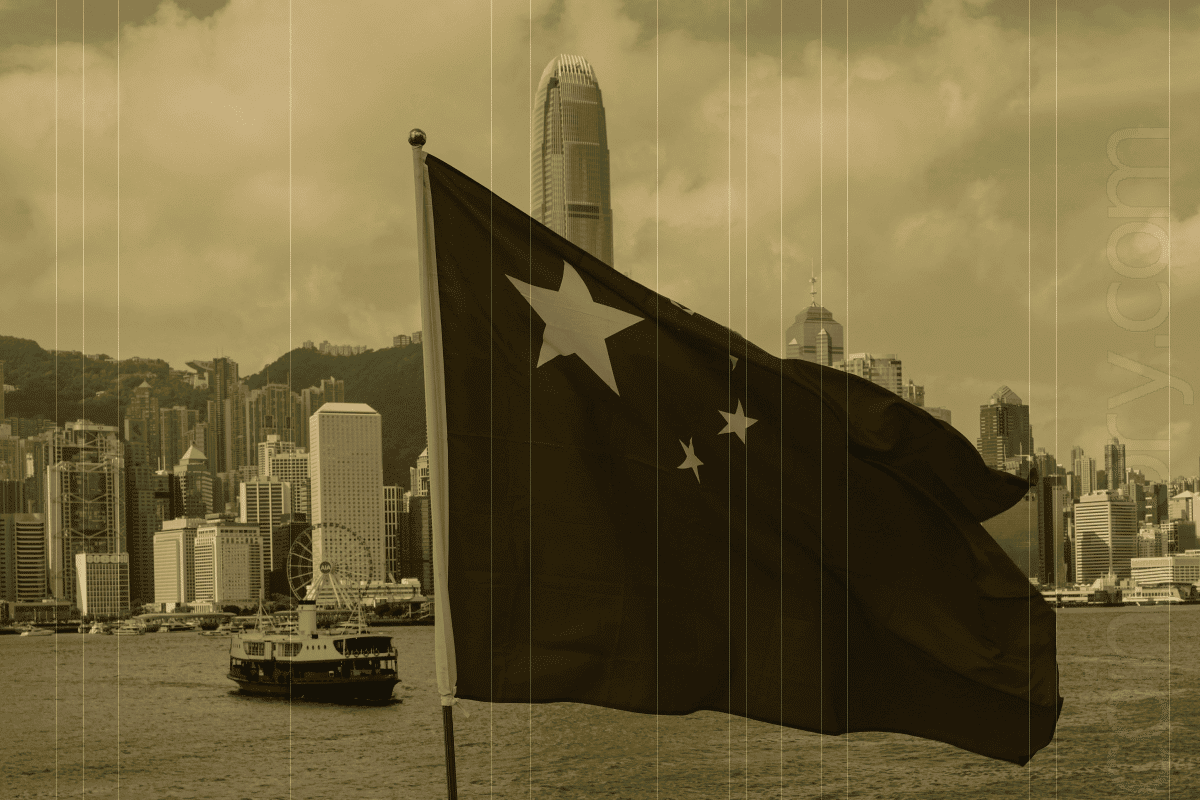

Hong Kong’s Progressive Approach

Contrasting with mainland China’s prohibition, Hong Kong’s regulatory framework has embraced digital assets. In June 2023, the region launched a licensing regime for digital asset trading platforms, permitting retail trading under regulated conditions. This initiative positions Hong Kong as a potential global crypto hub.

In August 2024, Hong Kong’s Legislative Council signaled its commitment to advancing digital asset legislation, with Council member David Chiu announcing plans to enhance regulation within 18 months. Key priorities include overseeing stablecoins and conducting sandbox tests to refine regulatory frameworks.

Major financial institutions operating in Hong Kong, such as HSBC and Standard Chartered Bank, are now mandated to monitor digital asset transactions as part of their standard compliance processes.

International Coordination on Digital Asset Regulation

The PBOC underscored the importance of a unified international regulatory approach, aligning with recommendations from the Financial Stability Board (FSB). In its July 2023 framework, the FSB advocated for stronger oversight of crypto activities, citing risks posed by increased adoption of cryptocurrencies in payments and retail investments.

“While the connections between cryptocurrencies and systemically important financial institutions remain limited, growing adoption in some economies poses potential risks,” the PBOC stated.

As China maintains its cautious stance on digital assets, Hong Kong’s progressive policies exemplify a dual approach to navigating the rapidly evolving crypto landscape.