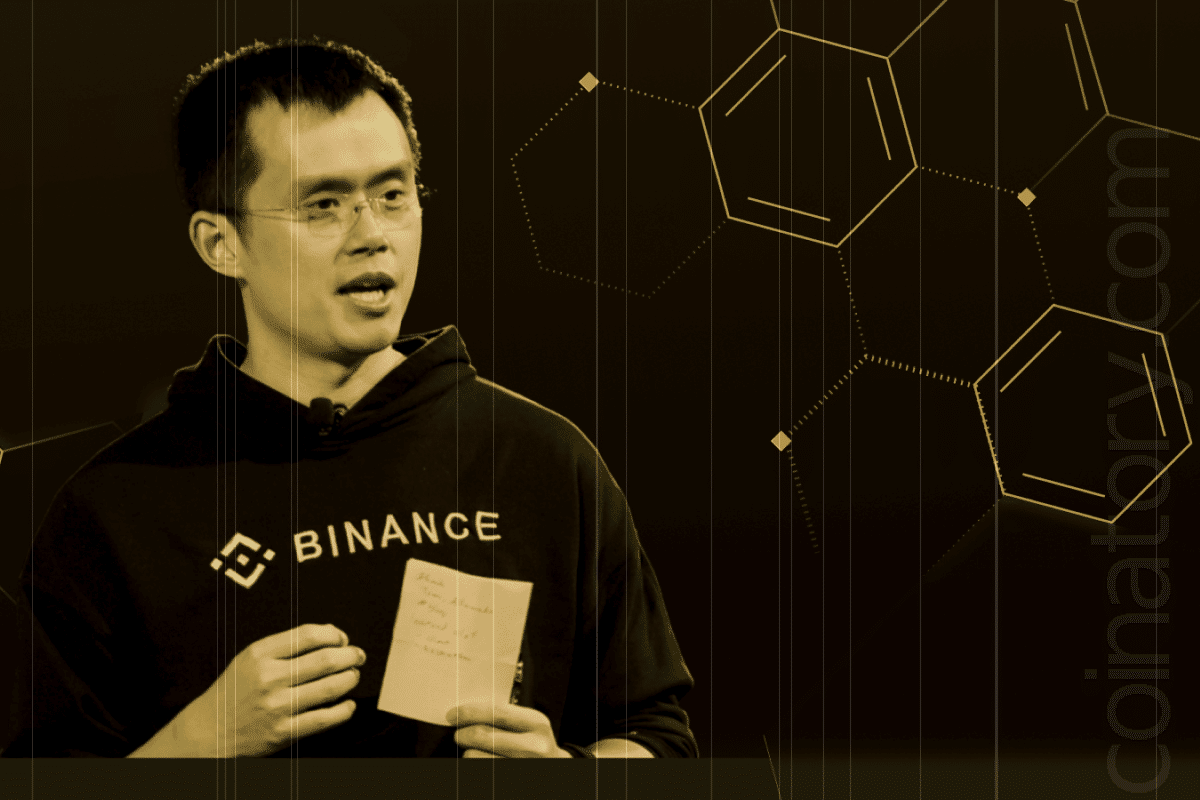

In a recent judicial decision, Changpeng Zhao, the founder of Binance, the largest cryptocurrency exchange globally, was sentenced to a four-month prison term. The sentencing, which took place on April 30, marked a significant chapter in the legal scrutiny surrounding the cryptocurrency magnate.

During the proceedings, federal prosecutors from the Department of Justice (DOJ) advocated for a three-year incarceration. In contrast, Zhao’s defense argued against any prison time. However, Judge Richard Jones ruled in favor of a substantially reduced sentence, diverging significantly from the DOJ’s recommendation. He highlighted the absence of clear evidence that Zhao was directly informed of the specific unlawful activities purportedly taking place on his platform.

Judge Jones also acknowledged the comprehensive report submitted by the prosecution but expressed partial agreement with their assessments. This legal narrative unfolded after Zhao, along with the Binance platform, entered a guilty plea in November to charges related to violations of U.S. anti-money laundering and sanctions regulations. This plea was part of a broader settlement with U.S. authorities, which allowed the exchange to maintain its operational status. Under the terms of the settlement, Zhao was required to resign from his role as CEO and agreed to a personal fine of $50 million. Additionally, Binance was mandated to pay $4.3 billion.

Furthermore, in a move to secure his temporary freedom until the sentencing phase, Zhao posted a substantial $175 million bail. Following this, in November 2023, U.S. prosecutors sought to impose travel restrictions on Zhao, citing the risk of him forfeiting his substantial collateral and potentially living abroad comfortably.

This case underscores ongoing tensions between regulatory authorities and the burgeoning cryptocurrency sector, highlighting the stringent oversight facing industry leaders.