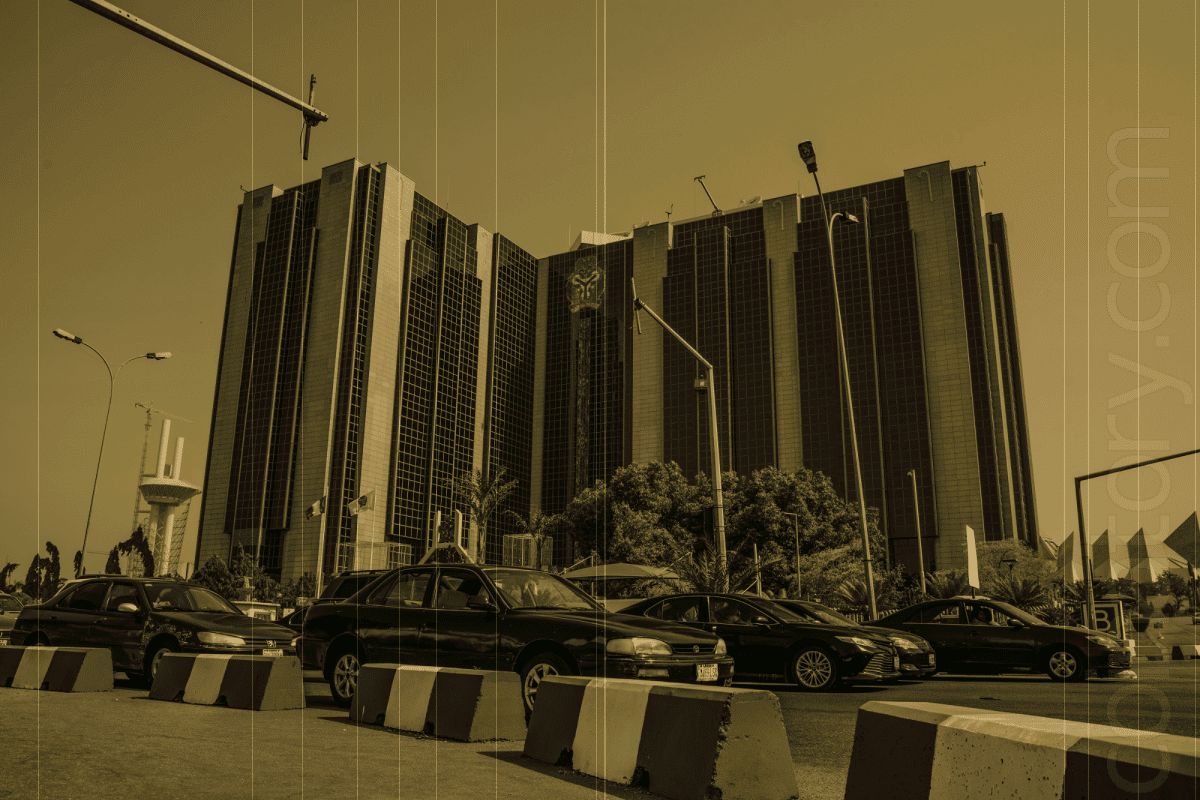

The Central Bank of Nigeria recently reversed its ban on local banks and financial institutions from providing services to cryptocurrency companies. This decision, announced last week, overturns a 2021 directive that prohibited these institutions from engaging in cryptocurrency transactions. Although the Central Bank of Nigeria (CBN) had clarified that it did not outright ban crypto trading, the restriction had led users to turn to peer-to-peer trading.

This change is likely to boost cryptocurrency adoption in Nigeria, a country rapidly embracing digital assets. The new policy enables crypto exchanges and service providers to open bank accounts, which could further increase adoption. Yellow Card, a leading pan-African exchange, intends to apply for a crypto license in Nigeria, in line with the new regulatory framework introduced in May.

Lasbery Oludimu, Chief Data Protection Officer at Yellow Card, views this policy shift as establishing a regulated environment that builds trust and confidence, expecting a significant rise in user adoption. The CBN’s move is in line with a worldwide trend of regulating cryptocurrencies, as recommended by international organizations like the Financial Stability Board and the International Monetary Fund.

A notable figure in the Nigerian crypto community expressed excitement, likening the CBN’s announcement to a “Christmas present.”