In a recent report from H.C. Wainwright & Co., analysts highlighted a mixed Q3 performance for Bitcoin mining firms, with volatile Bitcoin prices, regulatory shifts, and the looming April 2024 Bitcoin halving shaping the sector’s outlook. Despite the challenges, analysts suggest that the mining sector may present a near-term buying opportunity for investors.

Throughout Q3 2024, Bitcoin’s price fluctuations—driven by U.S. economic concerns, global geopolitical tension, and the 2024 U.S. presidential election—kept miners on edge. BTC prices hit a low of $49,100 in August but rebounded strongly to $63,250 by the quarter’s end after the Federal Reserve cut interest rates for the first time in four years in September, spurring a market rally.

Spot Bitcoin ETF Demand on the Rise

A surge in U.S.-based spot Bitcoin ETFs contributed to this recovery. Net inflows reached $4.3 billion in Q3, a notable increase from $2.4 billion in Q2. Analysts attributed a third of these inflows to the days immediately following the Fed’s rate cut. The upcoming November 5 election could further impact BTC prices, with analysts forecasting that a Trump victory might drive Bitcoin to new highs, while a Harris win could prompt a temporary pullback.

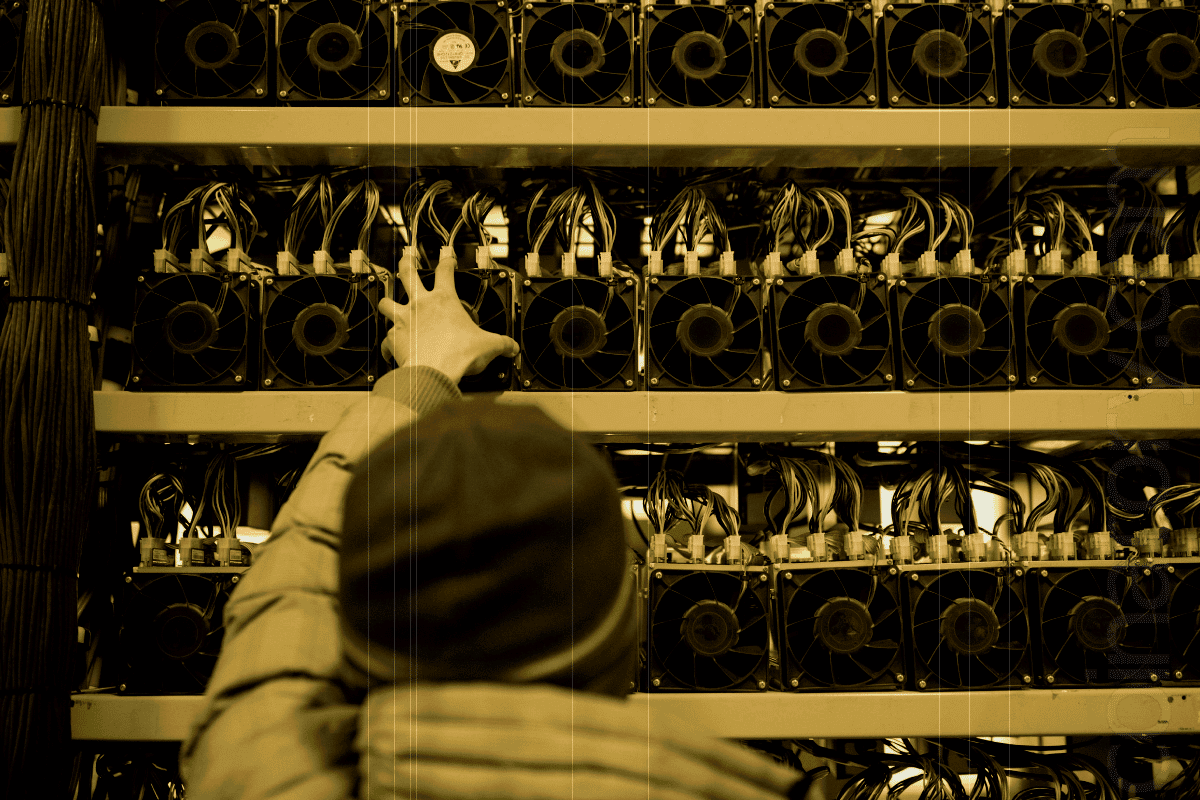

Mining Expansion and Halving Challenges

Public Bitcoin miners expanded operations in Q3, increasing the global hash rate by 35 exahashes per second, marking a 4.5% boost from the previous quarter. However, miners remain wary of the approaching Bitcoin halving in April 2024, which will reduce mining rewards by 50%, underscoring the need for operational efficiency to maintain profitability as Bitcoin’s supply growth slows.

The halving is part of Bitcoin’s fixed-supply design, capping circulation at 21 million coins to manage inflation. While intended to support BTC prices long-term, the halving could pressure miner revenues unless prices continue their upward trajectory.

Earnings Season Outlook

Revenue challenges were evident in Q3, as miner income dropped 29% to $2.6 billion, compounded by a significant decrease in earnings per terahash. Despite these hurdles, analysts view the sector’s 7% drop in combined market capitalization as a potential entry point for investors. Notably, public Bitcoin mining stocks have rebounded 12% in the current quarter, signaling resilience ahead of Q3 earnings reports set to begin this week.

With BTC trading above $73,000 this week, the industry’s profitability outlook will be a focal point for investors as miners navigate the lead-up to the halving.