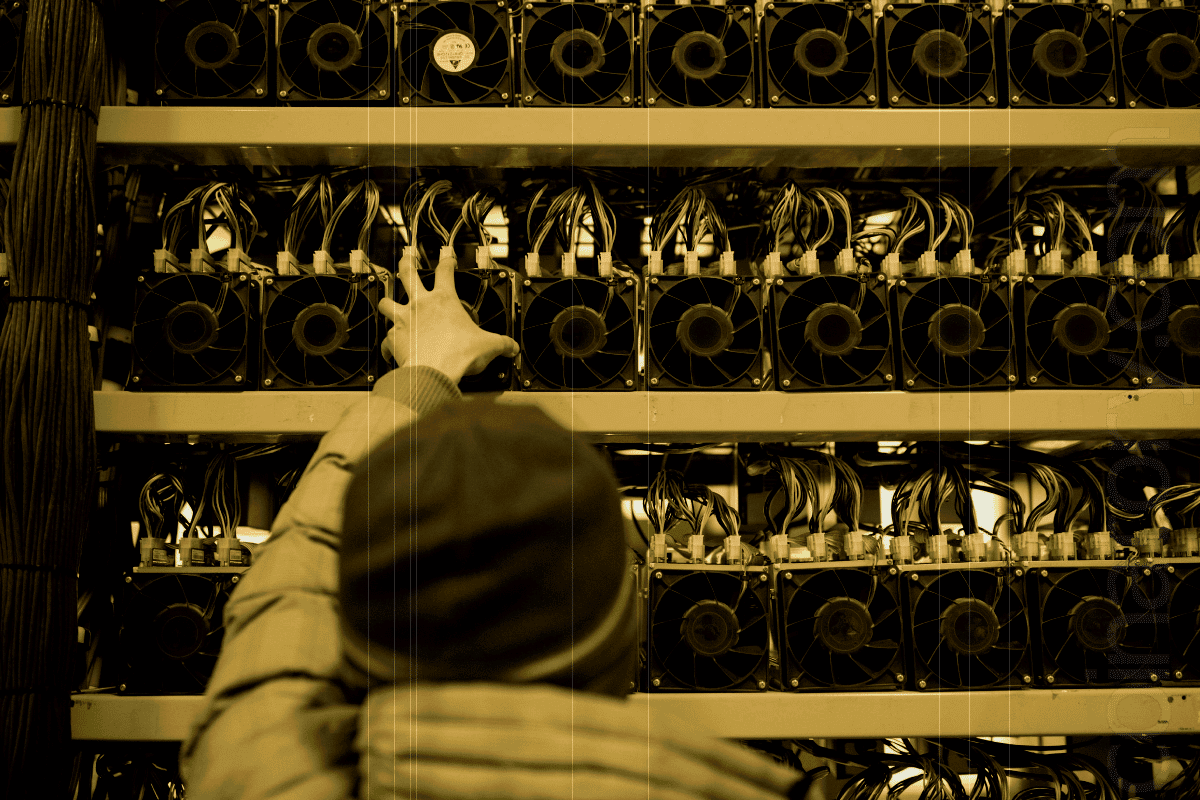

American Bitcoin, a majority-owned subsidiary of Hut 8 Mining Corp and co-founded by Donald Trump Jr. and Eric Trump, has secured $220 million in funding through a private placement, aimed at expanding its Bitcoin mining infrastructure and strengthening its on-chain treasury reserves.

Eleven million shares were issued as part of the capital increase, which was revealed in a regulatory Form 8-K filing with the U.S. Securities and Exchange Commission. The company’s intention to increase its exposure to digital assets was highlighted by the noteworthy fact that $10 million of the revenues were paid in Bitcoin, with an average acquisition cost of $104,000 per BTC.

American Bitcoin’s Bitcoin treasury had 215 BTC as of June 10. The new investment will help the company buy cutting-edge mining machinery and put it in a better position to grow.

The Trump-affiliated business, which Hut 8 recently acquired a majority stake in on March 31, is a component of a larger expansion plan. A representative for the company explained that although Hut 8 is now preparing to establish a trading office in Dubai under the name Hut 8 Investment Ltd., the Dubai operations are separate from those of American Bitcoin. According to CEO Asher Genoot, the Dubai effort aims to improve digital asset accumulation and capital allocation in the context of the UAE’s advantageous regulatory environment.

Additionally, American Bitcoin is getting ready to become public by merging with Gryphon Digital Mining, which is listed on the Nasdaq. The deal, which is set up as a stock-for-stock merger, will give the merged company the American Bitcoin moniker. Following the merger, current American Bitcoin stockholders will own 98% of the new company, with Eric Trump expected to join the board. Hut 8 will continue to oversee daily operations.